If you were not born into wealth, does that mean achieving financial independence is out of reach?

Not according to a national study of US millionaires conducted by Ramsey Solutions, a financial advisory firm. They concluded that “79% of millionaires did not receive any inheritance at all from their parents or other family members.”

This is not unique to the US. About 60% of Dubai millionaires are also self-made, according to the Khaleej Times.

What then is the secret of living a golden life? About 75% of those interviewed by Ramsey Solutions said regular and consistent investing over a long period led to their success.

Does this seem unrealistic? Then consider that if you invest AED 10,000 at the end of every month for the next 10 years in a portfolio that generates an 8% annual return (that compounds every quarter), will have AED1,824,086.73 at the end of year 10.

In this beginner guide to investing, we will help you understand how to invest money in the UAE so you can also build wealth for yourself and your loved ones. We’ll cover:

- Preparing to invest: Taking control of your finances

- Where to invest money in the UAE? UAE investment opportunities

- How to invest money in the UAE: 4 principles for beginners

- Creating an investment plan

[Do you want to know more about how to invest money in the UAE? Subscribe to our newsletter today to have weekly investing resources delivered to your inbox]

1. Preparing to invest: Taking control of your finances

“The building blocks of growing wealth are creating a gap between your income and expenses and then investing the surplus in something that produces income or appreciates in value over time,” according to Elie Irani, an IT professional and personal finance enthusiast, in a podcast episode with Sarwa.

Before considering the second part – investing the surplus – let’s spend some time helping you pull your finances together so you can create a gap between your income and expenses.

Have a budget

The best way to gain control of your finances is to have a budget. “A budget is telling your money where to go instead of wondering where it went,” according to John Maxwell.

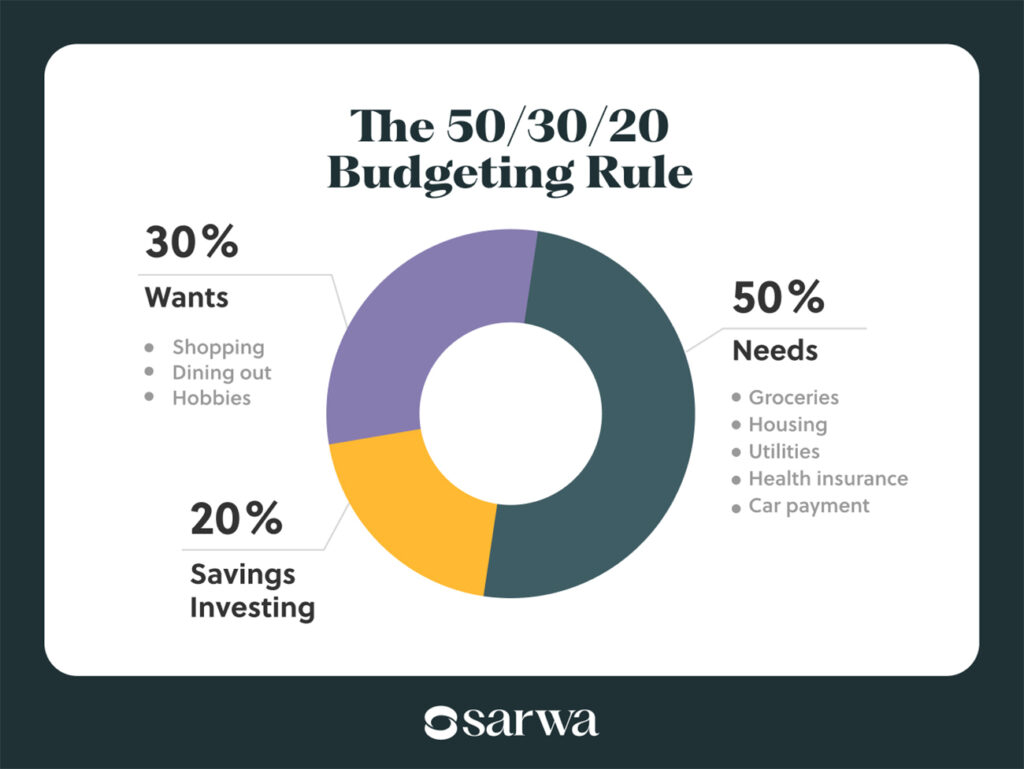

One popular budgeting rule that we also recommend is the 50/30/20 rule. This requires that you spend 50% of your monthly income on your needs (rent or mortgage, clothing, utility bill, etc.) and 30% on your wants (entertainment, hobbies, eating out, etc.). The remaining 20% is your monthly savings.

This 20% is so important since one of the aims of budgeting is to ensure that you are spending less than you earn.

Stick to your budget

It is not enough to have a budget, you need the discipline to stick to it. For our purposes, the best way to stick to your budget is to save before you spend. One of Warren Buffett’s quotes is that you should not “save what is left after spending, but spend what is left after saving.”

If you keep your savings in the same account you keep the money you spend on needs and wants, then the temptation is always there to overspend.

To counter this, it is best to first remove your savings and put it in your investment account while you develop the discipline to stick to the amount you have allocated for your needs and wants.

Create an emergency fund

Before considering the best investments in the UAE, you should learn how to start an emergency fund.

An emergency fund is money set aside to cater for unplanned and unexpected expenses resulting from job loss, medical crises, natural disasters, and unexpected repairs, etc.

If you start investing without an emergency fund, you may end up liquidating your investments when emergencies arise. Or you may have to rack up credit card debt (or any other form of consumer debt) and pay exorbitant interest on such.

An emergency fund is a better alternative. Financial advisors often advise that such an account should have up to six months’ worth of your living expenses (needs and wants).

For emergency funds, the primary factor is the ease of access (liquidity) rather than profitability. Put your emergency funds where you can access them when (and only when) emergencies arise.

2. Where to invest money in the UAE? UAE investment opportunities

If you implement the three strategies above, then you already have a consistent and regular source of investment capital: 20% of your income.

But how should you invest this money?

Financial scams are everywhere! Maybe you have been approached by money doublers who promised to double your money in days or those who said they would make you millionaires in weeks.

Instead of being captivated by such get-rich-quick schemes, you should focus on investment assets that people have successfully used to build wealth over centuries.

A second point is in order. While starting your business is an option to build wealth, the entrepreneurial journey is uncertain (90% of them fail, according to Investopedia, the financial education website) and often requires a large capital outlay (that beginners don’t have) to achieve decent success.

Therefore, as Irani advised in the podcast quoted above, we will focus on the financial markets since they have “low entry points” (no entrepreneurship skills needed) which makes them available to the average Joe.

So, then, what are these safe investment options in Dubai for Emiratis and expats?

1. Stocks

A stock is a portion of a company’s capital that individual and institutional investors can own.

When you purchase a company’s stock, you own a portion of the company. There are two ways to make money from stock ownership:

- Dividends: Most companies decide to share a portion of their net income with shareholders. This portion is called a dividend. The company pays a dividend based on the number of shares you hold. Most companies pay dividends every three months.

- Appreciation in the stock price: For our purposes (long-term investing), the appeal of stocks is how their prices can rise over the years. For example, 10 years ago (August 1, 2014), a share of Google (GOOG) sold for $28.23. On August 1, 2024, the closing price was $172.45. That is a 511% increase.

If you had invested $1,000 in GOOGL 10 years ago, that money would be worth $6,109 by now.

How to invest in the stock market

To invest in the UAE stock market, you will need a stockbroker, who will provide you access to any of the three stock exchanges in the UAE — Dubai Financial Market (DFM), NASDAQ Dubai, and Abu Dhabi Securities Exchange (ADX).

A stockbroker is an intermediary that facilitates transactions between buyers and sellers on stock exchanges. As an individual, you cannot buy or sell stocks in the UAE stock market (or any others) without a broker. Therefore, learning how to invest money in the UAE stock market begins with choosing the right broker.

Any broker operating in the UAE will give you access to any of the three UAE stock exchanges above.

However, if your financial goals require you to buy foreign US stocks like Apple, Google, Facebook, etc., you will need a broker that can grant you access to international stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ.

But why should you learn how to buy US stocks in the UAE?

It is no secret that the largest and most successful companies are in the US. This should not be surprising since the US remains the wealthiest country in the world.

Consequently, the US stock market remains the greatest source of wealth for stock investors. Furthermore, it is the largest in terms of capitalisation, transaction volume, and the number of listed companies.

Since our aim is to build wealth, focusing on the US stock market is a no brainer.

2. Bonds

A bond is a debt instrument that governments and corporate companies use to raise money. For our purpose, there are three types of bonds:

- Corporate bonds: Company issuances

- National bonds (Treasury bonds): Federal government issuances

- Municipal bonds: Local government, state, city, and local community issuances

You can make money from bonds in two ways:

- Interest payment: Bond issuers make interest payments to bondholders twice a year. Unlike stocks, bonds have a fixed interest rate.

- Growth in the bond value: You can also make money when a bond grows in value. When the interest rate drops and new bonds are issued at lower interest rates, your bond’s value (which was issued at a higher interest rate) rises. When the stock market is down, many people turn to bonds, sending their prices up.

Bonds are generally issued for a long period.

Unlike stocks that you can own forever (provided the company does not repurchase them), you can only hold bonds for a predefined period.

Bonds provide a consistent stream of income for a certain amount of years, such as 10-year and 20-year bonds. You can also earn on them by selling them at a higher price before maturity.

Bonds are considered less risky compared to other investments and are typically used as a counterbalance to stock investments.

“Every portfolio benefits from bonds; they provide a cushion when the stock market hits a rough patch,” says Suze Orman, founder of Suze Orman Financial Group. “Every portfolio benefits from bonds; they provide a cushion when the stock market hits a rough patch.”

However, their return is not as high as stocks: less risk equals smaller returns.

When it comes to investing in corporate bonds, investors should conduct diligent research to understand if the company has a low-risk profile, as defined by bond rating agencies.

3. Mutual funds

For those without the time or skills to evaluate the stock market (and that is most of us), stocks and bonds are also available for purchase through mutual funds.

A mutual fund (also known as investment fund) pools money from various individual investors and invests them in stocks, bonds, and other fixed-income securities under a fund manager’s supervision.

The fund manager is an expert who understands the market and has the experience and skills to choose individual stocks or bonds.

By pooling a large sum of money from different individuals, mutual funds offer diversification as they can invest in more companies.

When someone purchases a mutual fund, they own a portion of the mutual fund rather than the individual investments (the mutual fund operates as a company). In other words, the shareowner doesn’t own the stocks or bonds the mutual fund purchases; instead, they own the mutual fund itself.

Within a mutual fund, there are equity funds, fixed-income (debt) funds, balanced (hybrid funds), and specialty funds.

How do mutual funds make money?

- Dividend/interest: When the stocks or bonds the mutual funds purchase pay dividends or interest, they distribute it to the mutual funds’ shareowners depending on the number of shares.

- Appreciation in the mutual fund’s value: The price of a mutual fund increases as the value of the stocks and bonds it possesses increases. Also, the price of a mutual fund rises as the demand for it increases.

As the mutual fund grows, the value of the share price grows.

There are different types of mutual funds based on how they trade and the investments they purchase.

Based on trade, there are:

- Open-ended mutual funds: These are mutual funds you can buy or sell throughout the year. You can add more units or sell the ones you have.

- Close-ended mutual funds: You can only sell close-ended mutual funds at a specific maturity date. You hold it until maturity.

Based on the philosophy of investing, there are:

- Passively-managed funds: Passively-managed mutual funds (also known as index funds) attempt to match the performance of the market instead of trying to beat the market. They don’t buy and sell their investments frequently or incur higher management fees or taxes.

An index is a basket or umbrella of securities. For example, the S&P 500, which is the most popular stock market index, is a basket that contains the 500 largest US stocks.

An index fund seeks to mirror the performance of an index by investing in the securities that make up that index. That is, it is content to earn the same returns that the index earns.

Consequently, an index fund only buys and sells securities when the composition of the underlying index changes.

- Actively-managed mutual funds: Actively-managed mutual funds attempt to outperform the market. They usually have an index that serves as a benchmark for their performance. Instead of tracking this index, they seek to achieve a higher return.

To achieve this aim (which they rarely do), they frequently buy and sell stocks, bonds, and other investments that constitute the fund. Unlike index funds that buy and sell only when an index’s composition changes, mutual funds buy and sell regularly in pursuit of better returns.

Consequently, they incur higher fees, making them more expensive.

Also, the higher risk they expose investors to are not always compensated for with higher returns (given how active funds have underperformed in recent years).

Similarly, active mutual funds are not transparent; they value flexibility more than transparency.

Therefore, it’s difficult to know the investments an active mutual fund is holding at a particular time. What they hold today can change before you wake up the next day.

As we will still see, understanding the difference between active and passive investment is essential to your wealth-building journey.

How to find the best mutual fund in the UAE

Mutual funds in the UAE can be broadly classified into two categories: local and international. Local mutual funds invest in local securities available on DFM, ADX, or NASDAQ Dubai. Thirty-three such mutual funds are currently listed on the Securities and Commodities Authority (SCA) website.

In addition, there are international mutual funds that invest in securities in international exchanges like the NYSE and NASDAQ.

Whether local or international, you must consider these four factors to determine the best mutual fund in the UAE:

- Investment objective: The first thing is to consider the investment objective of the fund and see if it aligns with yours. Here, an understanding of your risk tolerance is important. The risk a mutual fund is taking to achieve its investment objective should not be more than what you are comfortable with.

- Past performance: Consider how the mutual fund has performed (returns) in past years in comparison with similar funds. If other funds with similar objectives are outperforming it or if its returns are declining year-on-year, it is not good for you.

- Expense ratio: The expense ratio is the portion of a mutual fund’s assets under management (AUM) that goes to its operating expenses. When the value of a mutual fund increases, not all of that added value goes to investors, some if it goes to the operating expenses. Consequently, the higher the expense ratio, the lower the profit you can expect to earn on your investment. Hence, for similar investment objectives and past performance, choose a mutual fund with a lower expense ratio.

- Customer service: Customer service includes the ease with which you can contact the fund’s management, the reporting analytics they provide, and how much they try to be accountable and responsive to you.

The best mutual fund in the UAE will have investment objectives similar to yours, competitive performance (returns) and expense ratio, and excellent customer service.

4. ETFs

Exchange-traded funds (ETFs) are today’s go-to example of popular passive investments.

Over the past decade, ETFs have become one of the most popular investment assets used to achieve diversification. By owning a share of one ETF, an investor gains exposure to numerous stocks or bonds within that basket.

For example, the iShares Core MSCI EAFE ETF (IEFA) tracks a broad range of companies across many industries in markets across Europe, Australia, Asia, and the Far East (developed markets excluding the US and Canada). When an investor purchases a share of IEFA, they are purchasing exposure to large-, mid-, and small-capitalization market equities across these regions.

While a single ETF offers a lot of diversification, purchasing many ETFs offers even more.

For example, an investor can purchase an ETF of US stocks together with an ETF of international stocks, an ETF of global REITs, and an ETF of US bonds.

Apart from the diversification each ETF offers, you enjoy more diversification (and less portfolio risk) by combining various ETFs that spread across broadly different markets.

Instead of buying individual stocks, bonds, or REITs, the investors can use ETFs as part of a strategy to gain more diversification, and at a fraction of the cost.

ETFs vs. Mutual Funds

Since diversification is the same motive behind mutual funds, how then do they differ from ETFs?

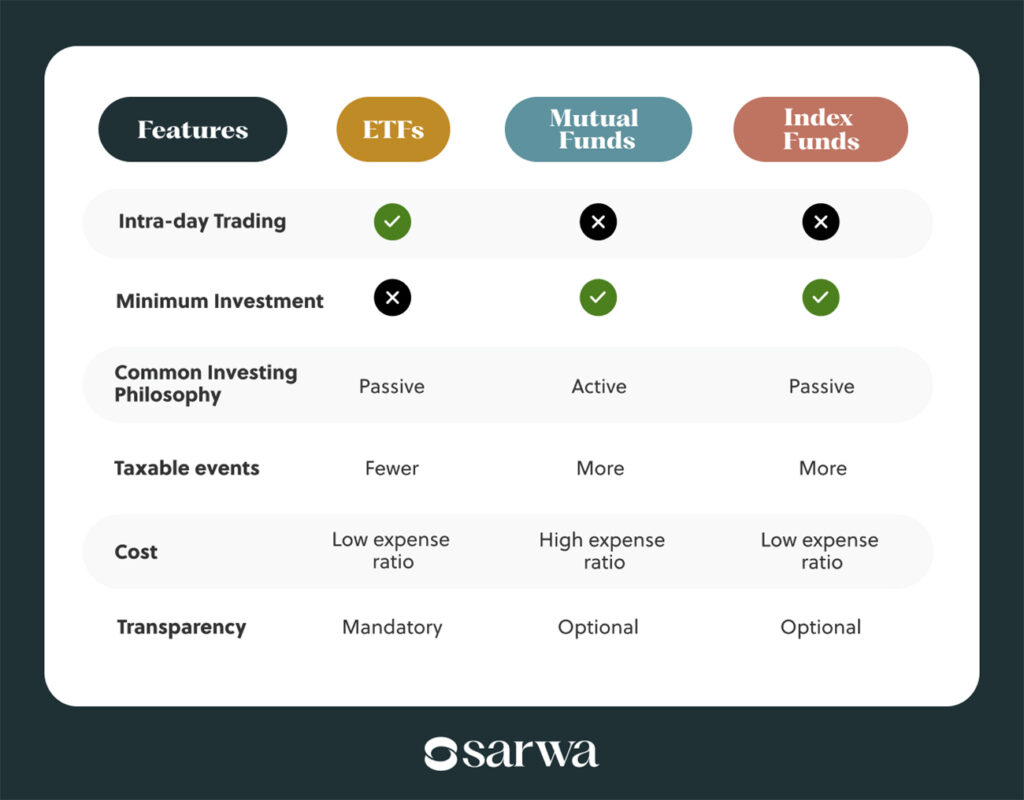

There are at least five differences between the two:

- Transparency: ETFs are mandated by law to publish the details of their holdings at least every quarter. Mutual funds don’t have such a mandate. While many ETFs publish the details of their holdings daily, most mutual funds prefer not to publish such details as a way to protect their investing strategy (trade secret).

- Minimum investment requirement: Most mutual funds will require you to invest a minimum amount before you can get started. However, ETFs allow you to start with just a single share or even a fraction of a share. This makes ETFs the best option for small investment in Dubai and the best investment in UAE for expats who are just finding their feet.

- Investment philosophy: While mutual funds are actively managed, 80% of ETFs are passively managed.

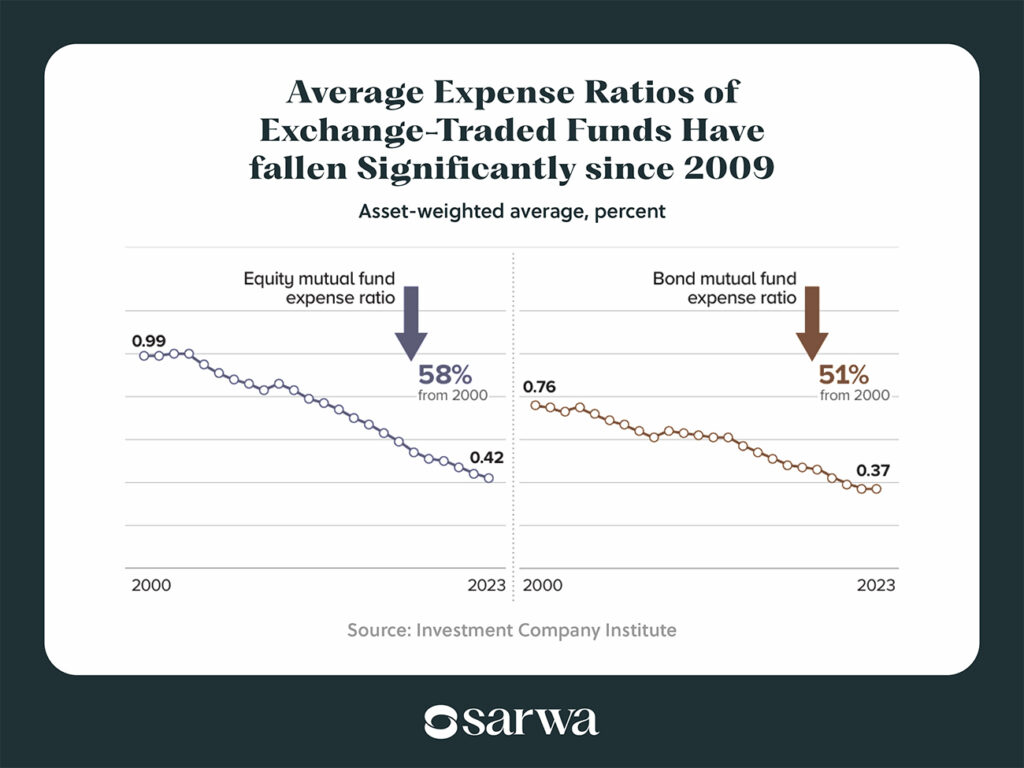

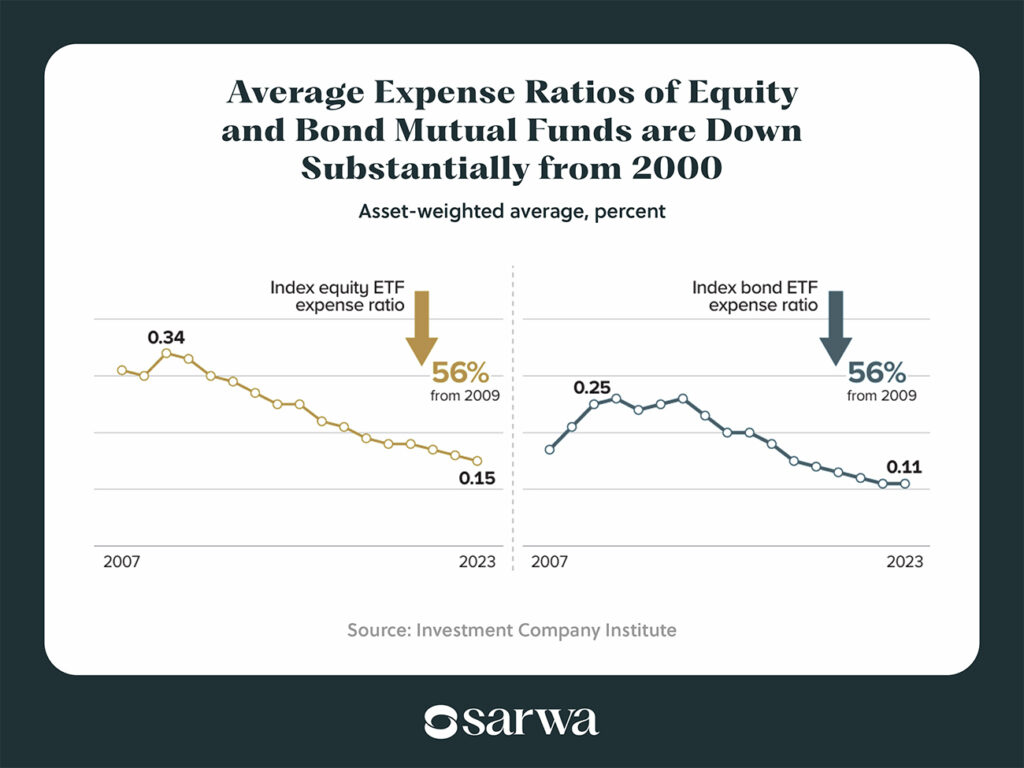

- Expense ratio: Since mutual funds are actively managed, they incur higher management (operating) fees. Though their expense ratio has been falling, they are still higher than that of mutual funds.

For example, while equity ETFs averaged 0.15% expense ratio in 2023, equity mutual funds averaged 0.42%, according to Investment Company Institute, an association of regulated investment funds.

Source: Investment Company Institute

- Trading time: While you can only buy mutual funds at the end of trading hours, you can buy ETFs any time during trading hours. The advantage of this is that you can liquidate your ETFs at any time without waiting for trading to close for a day.

ETFs vs. Index Funds

So why invest in ETFs and why not only in the S&P 500 through an index fund?

First, index funds function similar to mutual funds that are passively traded. They are also passive investments like ETFs.

However, while ETFs are traded throughout the day on stock exchanges, you can only buy an index fund at the close of the market.

Below are some of the advantages of ETFs over index funds:

- ETFs are cheaper than index funds. Though they are both passive investments, ETFs have lower cost and less tax obligations.

- ETFs are more liquid since you can buy them throughout the day on an exchange. You don’t have to wait till the close of the market to buy an ETF. Buying and selling is easier.

- ETFs are more transparent. The price of an index fund is decided when the fund manager calculates the fund’s Net Asset Value (NAV) at the end of the day. You can’t know what you will pay until the fund manager finishes his calculations.

The price of an ETF is directly determined by the market forces of supply and demand. Investors thus know the current price at every point in time. In this sense, ETFs are democratic, says Vanguard’s Mark Fitzgerlad, Head of Product Specialism.

- ETFs also offer better diversification. Investors today have at their disposal a widening range of ETFs that offer more diversification than ever before. There are innovative ETFs that invest in niche products and industries.

Some ETFs focus on emerging and developed markets. There are global and international ETFs as well as industry-specific ETFs. The large range of ETF products out there will help you achieve better diversification than index funds.

5. Real Estate Investment Trusts (REITs)

Many rich people have accumulated wealth in the real estate market. The Dubai real estate market is especially booming and many investors from across the globe are chipping in.

But is investing in real estate safe?

Not if you are a beginner.

Real estate requires a huge capital outlay, diversification is hard (you need a lot of money), managing tenants is difficult, many fees can eat into your profit, and the market is illiquid (not easy to quickly sell properties and turn them to cash without selling at a discounted price).

Thus, while we recognize that real estate, in general, is one of those time-tested investments, we believe that beginner investors should start with REITs.

REITs are stocks of companies that purchase real estate properties (Equity REITs) or provide mortgage facilities to real estate investors (Mortgage REITs).

REITs are bought and sold like the shares of any other company. Instead of buying properties and managing them, investors hold the shares of companies that are investing in the market (including mortgage lenders).

REITs earn money through dividends and appreciation in the price of the REIT. They often pay regular dividends (they pay most of their income as dividends), providing a stable income source to the investor.

They are great options for those looking for how to invest money in the UAE and want to gain exposure to real estate without the risks of owning a property.

The best way to own REITs is by buying them as ETFs. Buying individual REITs has the same downside as buying individual stocks.

Just as there are equity ETFs and bond ETFs, there are also REITs ETFs that add to the diversification of your portfolio.

6. Gold

We cannot talk about where to invest money in the UAE without mentioning gold.

Gold has been considered a store of value because its supply is limited and cannot be increased arbitrarily. Many investors run to it as a safe haven during deflationary, inflationary, and recessionary periods.

It proved its value as an inflation hedge during the 1970s but did not replicate the results in the 1980s, the 1990s, and the period following the COVID-19 pandemic.

However, it proved its value during the deflation of the Great Depression and it has outperformed the S&P 500 index in six of the eight recessions between 1973 and 2020, according to Forbes.

Source: Forbes

This tendency for gold to perform well during recessions (when stocks tend to underperform) has made many investors embrace them (in the same manner as bonds) as a way to diversify their portfolios.

Learning how to invest in gold in the UAE can help you diversify your portfolio as well as protect it during economic downturns. You can invest in gold bullion (tangible gold), stocks of gold companies (similar to REITs), gold mutual funds, gold futures and options, and gold ETFs.

7. Bitcoin

Since cryptocurrency has been a harbor for scams and cyber attacks, does it make sense to have it on a list of different ways to invest money in the UAE?

The answer is yes for one reason: bitcoin.

Like gold, bitcoin has a limited supply which makes it a good store of value, a potential inflation hedge, and an option for diversification.

Bitcoin’s ability as an inflation hedge was only theoretical given that inflation and inflation expectations had been low during the period of Bitcoin’s rise.

However, many academic researchers have shown that Bitcoin was a good inflation hedge during the inflationary period that followed COVID-19 even though its role as a safe haven (like gold) is still unproven.

Bitcoin also proved its usefulness for diversification when it maintained an almost zero correlation with the stock market between 2012 and 2020, according to data collected by Morning Star, a financial services firm. However, recent data shows that the correlation is increasing, making the role of Bitcoin as a diversification tool more doubtful.

What about the significant returns that Bitcoin seems to provide? While high returns are good, we must also consider the risk (often measured as volatility) associated with a crypto like Bitcoin.

Yet, a study published by KNE Publishing, an open access publisher in Dubai, that compared the risk-adjusted returns of various assets (through the Sharpe ratio and Treynor ratio) found Bitcoin to have a higher Sharpe ratio than gold and stocks.

Given the mixed nature of these results, it is left to you to decide if Bitcoin should be part of your portfolio or not.

3. How to invest money in the UAE: 4 principles for beginners

Now that we have considered where to invest money in the UAE, let’s continue our consideration of how to invest money in the UAE by looking at four key principles that you must embrace as a beginner investor.

Long-term investing

While there is nothing wrong with short-term trading of stocks or ETFs (or any other asset), long-term investing is the best way for beginners to build wealth in the financial markets.

Though the figure differ (1%, 4%, 5%) depending on who is writing about it, it is a fact that only a tiny percentage of traders make money consistently after brokerage fees.

With trading, the probability of huge financial losses is high. Even though huge profits are possible, the balance of both (after fees) does not make sense for most traders.

As Irani said (recollecting what he read from Tony Robbins, life coach and business strategist), trading is not for the average Joe and 95% of people are better off investing in passive index funds (passive ETFs in our case).

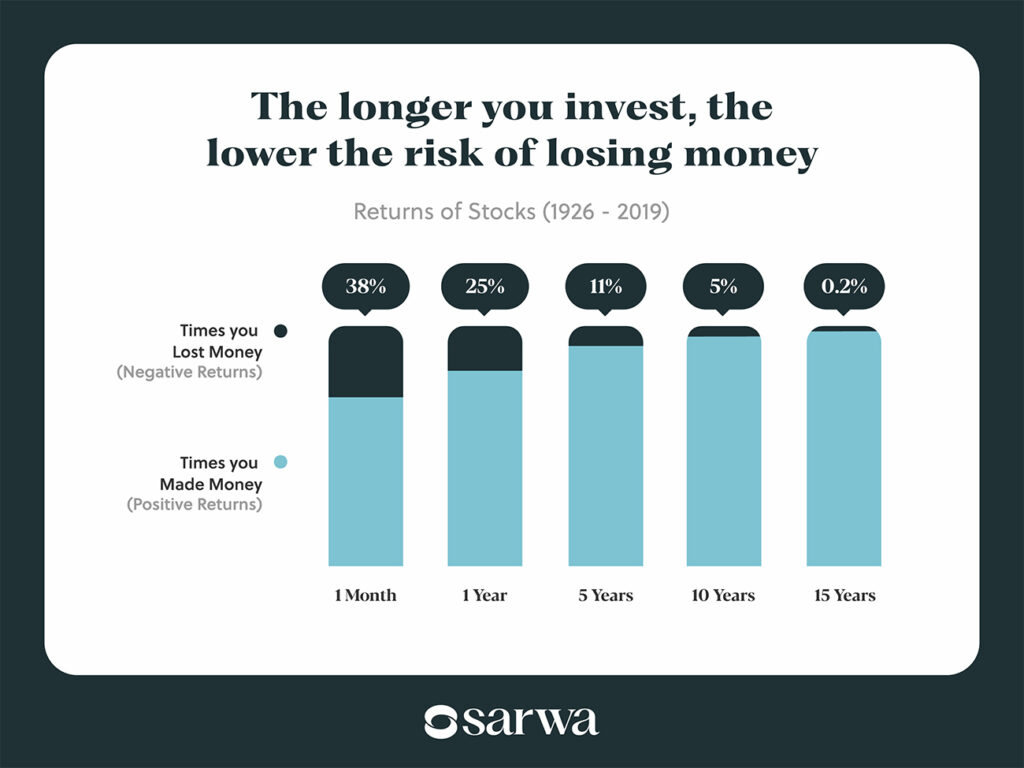

In contrast, the longer the time you spend in the market, the lower your chances of losing money and the higher your chances of making money.

This is the conclusion from a study by Morning Star that analyzed stock market performance between 1926 and 2019. The result is presented in the following chart:

Warren Buffett once said that the first investing rule is not to lose your money and the second rule is to remember the first. Long-term investing is a great way to follow this rule.

But the good news is not that you don’t lose money, it is that the money you don’t lose keeps working for you month in, month out, year in, year out until a ripple turns to a wave and a wave into a tidal wave.

It’s no surprise then that the self-made millionaires we encountered pointed to steady and consistent long-term investing as the secret for their success.

Diversification

You have probably heard the popular investment adage, “Don’t put all your eggs in one basket.” It’s not enough to know where to invest (the best investments in the UAE), knowing how to combine these various investments in a way that minimises risk and maximises return is crucial to building wealth over the long term.

Putting your eggs in different baskets — that is, diversification — ensures that your overall investment risk is reduced. To understand how this risk reduction occurs, we’ll need to first review a bit about correlation and risk.

Correlation, risk, and diversification

When two investments are positively correlated (correlation coefficient is greater than 0), they move in the same direction — when one falls, the other falls with it. If this positive correlation is perfect (correlation coefficient is +1), the direction and magnitude of fall is the same — a 20% fall in Asset A causes a 20% fall in Asset B.

In contrast, if two assets are uncorrelated (correlation coefficient is 0), a fall in one asset does not affect the other.

Even better, if the two assets are negatively correlated (correlation coefficient is between 0 and -1), a fall in one asset will cause the other to rise. If the negative correlation is perfect ( correlation coefficient is -1), a 20% fall in one asset will cause the other to rise.

A portfolio of uncorrelated and negatively correlated assets reduces your risk since a fall in one asset won’t lead to a fall in another asset(s). Instead, the fall will either impact no other asset (uncorrelated) or cause the other asset(s) to rise in value.

Four types of diversification

There are four different ways to achieve diversification:

- By asset class: Here, you need to combine different assets that are uncorrelated or negatively correlated to reduce risk. Stocks and bonds tend to be negatively correlated and REITs tend to be uncorrelated to bonds.

Correlation Between Various Assets From 2012-2020

Source: ETF Trends

From 2012 to 2020, US bonds have shown a negative correlation (-0.25) to US stocks (S&P 500) while the US Real Estate has shown a near zero correlation (0.01) to the US bond market.

The first level of diversification is to combine stocks, bonds, and REITs. As we have seen, gold and Bitcoin (to varying degrees) should also be considered.

- By industry: Ensure that the stocks, bonds, and REITs you purchase are not in the same industry. Choose industries that are uncorrelated or negatively correlated (oil and airline).

- By markets: Investing in markets that are uncorrelated or negatively correlated also increases the benefits of diversification. Instead of investing in only the US, invest also in emerging markets like Brazil and China and developed markets like the rest of North America and Europe.

- By market cap: Large-cap, mid-cap, and small-cap companies often have different characteristics that make them uncorrelated or negatively correlated to each other. Diversifying in those three categories can help further reduce portfolio risk.

Types of diversification

In summary, the best investment in the UAE is a diversified portfolio that contains different assets that are uncorrelated or negatively correlated.

[To learn more about the importance of diversification, read, “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why.”]

Passive vs. active investment

Passive investing has at least four advantages over active investing: low cost (fees and taxes), long-term focus instead of market timing, and less risk. On the other hand, the advantage that active investing was supposed to deliver — outperforming the market — has been hard to come by.

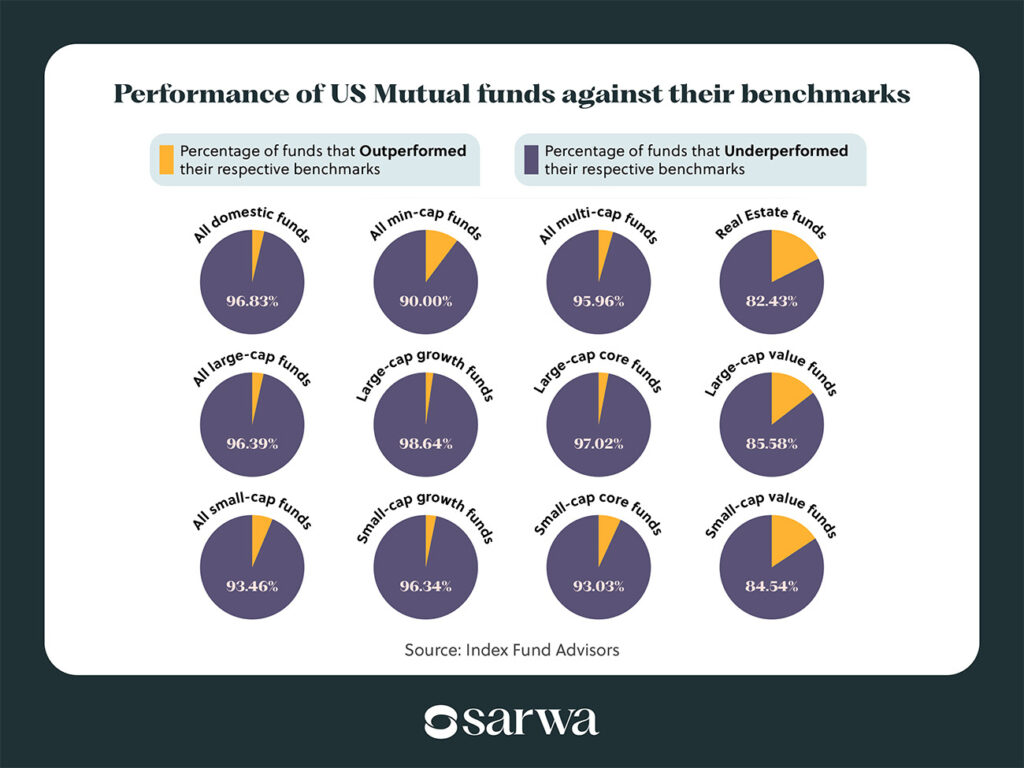

For example, 96.83%% of actively managed mutual funds in the US failed to outperform the market between 2004 and 2023, according to a 2023 S&P SPIVA report .

Performance of US Mutual Funds Against Their Benchmarks

Source: Index Fund Advisors

If mutual funds, with the diversification they enjoy and the expert investment managers they employ, find it hard to outperform the market, it is even more difficult for individual investors.

Therefore, a smarter approach is to track the performance of the market through passive investing while enjoying lower fees, risk, taxes, and a long-term focus that is not disturbed by the noise of the stock market.

Confident of the superior value of passive investing, Warren Buffett placed a $1 million bet with the managers of Protege Partners in 2007 that a passively managed index fund will outperform a collection of hedge funds over the next decade. When the results came in, the S&P 500 Index Fund had returned 7.1% and the hedge funds 2.2%. The message, in Elie Irani’s words, is: “don’t try to outsmart the market.”

Interesting, right? In addition to all the advantages listed above, you have the bet of the Omaha Oracle himself as an added confirmation of the value of passive investing.

In summary, passive investing is the best way to invest money in Dubai. This is why we advise investors to buy passively-managed ETFs (see above for why ETFs are better than index funds though they are both passively managed).

Using a robo-advisor

Though passive investing is simpler than active investing, there are still many decisions to make:

- How many ETFs should you buy?

- How should you diversify your portfolio?

- What portion of your investment capital should go to which assets?

We can summarize all of these questions under portfolio structure.

The portfolio structure is how you divide your money among various investments.

The key is to choose a portfolio structure based on your investment goals and current situation (time horizon). If you are closer to retirement, its advisable to have more bonds or bond funds. If you are young, you want more stocks or equity funds.

However, portfolio structure decisions do not have to be the equivalent of shooting in the dark. There are robo-advisors (automated financial advisors) that use technology and the latest insights in finance (such as the Modern Portfolio Theory) to create a customized portfolio for clients.

Robo-advisors are very cheap and they help you stay on course with your portfolio structure through periodic rebalancing.

Sarwa Invest is one such robo-advisory platform that helps investors grow their wealth by designing personalized portfolios of ETFs that match their time horizon, risk appetite (tolerance), risk capacity, and investment goals of investors.

For example, the portfolio structure below was designed for conservative (risk-averse) investors:

Typical portfolio for conservative investors

Compare this with the portfolio structure they use for growth (growth-seeking) investors:

Typical portfolio for growth investors

The difference in the above portfolios shows you how differences in investment goals and current situation affects your portfolio structure.

We can then modify our definition of the best investment in UAE: a diversified portfolio of uncorrelated or negatively correlated assets structured based on your investment goals and risk tolerance.

4. Creating an investment plan

Given that this is an ultimate starter kit, we have covered so many grounds. By the time you are here, you might have forgotten some of the points we noted.

To make it easier for you to remember the important details and act on them, we will conclude with practical steps you can take in the form of creating an investment plan.

Investing for beginners require an investment plan so you are not walking in the dark.

Below are the steps you should take to create a monthly investment plan in the UAE:

- Identify your goals and divide them by time period: For our purposes, you need to divide your goals into short, medium, and long-term.

This division is important because it is not adivsable to keep money for short-to-medium term goals (buying a car, downpayment for a house, paying a child’s school fees) in any of the UAE investment opportunities we have identified. While these assets can grow your money over the long term, they fluctuate in the short term.

Money for such goals are best placed in savings or fixed deposit accounts where they are not exposed to market fluctuations. You can even earn higher interest (without higher risk) with high-yield savings platforms like Sarwa Save.

- Allocate your monthly savings to your goals: If you have prepared a budget according to the 50/30/20 rule then you are consistently saving 20% of your income every month. Your investment plan will outline how you intend to allocate this money to your short, medium, and long-term goals.

There is no magic formula here. The allocation formula will depend on your scale of preference.

- Create or select diversified portfolios for your long-term goals: For long-term goals, which is our concern, you need a diversified portfolio of stocks, bonds, REITs (and maybe gold and Bitcoin).

For many people, there is only one long-term goal: retirement. If you have more than one (inheritance for your children for example), you can create multiple portfolios for each.

As we said, investing for beginners is easier if you allow a robo-advisor platform like Sarwa Invest to create such portfolios for you.

- Automate deposits to your investment portfolios: We mentioned the importance of saving before spending. Sarwa Invest makes this easy. You can automate deposits from your salary account to your portfolios on Sarwa Invest. This will ensure that you are not tempted to overspend.

- Keep your portfolios efficient: Sarwa Invest will automatically rebalance your portfolios to make sure the efficient portfolio structure they have created remains intact after market movements have altered it.

Imagine having to do this yourself? This is another advantage of robo advisory platforms.

Because of the rapid effects of compounding, the best time to start your investment journey is today.

Sarwa can help you build an investment portfolio that best matches your personal profile and investment goals.

Thanks to innovative financial technology and our emphasis on the passive approach to investing, Sarwa is able to offer low fees and a good record of maximizing returns.

[Do you want to build wealth in the UAE? Sign up for Sarwa Invest to invest in a personalised and diversified portfolio of ETFs that matches your time horizon, risk tolerance, and risk capacity.]

Takeaways

- Most self-made millionaires point to regular, consistent, and long-term investing as the reason for their success.

- Before you can invest, you need to put your personal finance in order.

- The types of investments you should consider in the UAE include stocks, bonds, REITs, mutual funds, ETFS, gold, and Bitcoin.

- Successfully investing requires that you focus on the long term, diversify your portfolio, choose passive investment, and use a robo advisor.

- To build wealth, create diversified portfolios for your long-term goals and automate deposits from your bank account to those portfolios.