If you have rushed into the world of bitcoin trading because of how much money you have seen or heard people make, then you probably have realised by now that it is not a free lunch.

Bitcoin remains a very volatile asset and profitably trading this (or any) crypto requires that you pay attention to certain bitcoin trading advice – the dos and don’ts of bitcoin trading, so to speak.

But is bitcoin trading even profitable given the popularity of altcoins?

Though interest in altcoins (digital currencies apart from bitcoin – ethereum, ripple, etc.) is growing, bitcoin remains the most traded and the largest cryptocurrency by market capitalization. Moreover, bitcoin’s liquidity, trading volume, stability, increasing adoption as a currency, and popularity, make it a great cryptocurrency for traders.

Regarding profitability, consider that between June 19, 2023, and June 18, 2024, there was a 139% increase in bitcoin’s price. If you had invested $10,000, you would have $23,900 by now. In essence, you would have more than doubled your investment.

By May 22, 2024, bitcoin was still among the top 9 cryptocurrencies by yield-to-date, according to a report by Nerd Wallet, a personal finance management website.

In what follows, we will consider why bitcoin is still important for traders in the crypto market and then highlight important bitcoin trading advice that can help improve your chances of becoming a consistently profitable bitcoin trader. We’ll cover:

- Why you should trade bitcoin

- The main bitcoin problems today

- Bitcoin trading advice: The do’s of bitcoin trading

- Bitcoin trading advice: The don’ts of bitcoin trading

[Are you ready to start trading bitcoin? Sign up for Sarwa Trade to buy and sell bitcoin and other cryptos in a secure, cost-effective, and seamless way in the UAE.]

1. Why you should trade bitcoin

The lead-up to bitcoin halving on April 19, 2024, led to huge interest in the cryptocurrency as traders and investors expected its price to surge. This is in keeping with how past halving events in 2012, 2017, and 2020 preceded bullish runs and price surges.

From April 19, 2024, to the time of writing, the price has already increased by 9% and the full impact of the halving event is still yet to come.

But why should you trade bitcoin given that some altcoins will outperform bitcoin within any period?

Below is a fundamental analysis of bitcoin relevant for crypto traders:

Liquidity

Anyone who has spent time in cryptocurrency trading knows that liquidity is important when selecting a coin to trade.

When a coin is illiquid then it is hard to buy and sell them quickly. Traders may have to wait for some time, during which prices can move and affect the profitability of the trade.

Though liquidity is important for all traders, it is especially important if you are scalping or day trading and you have to open and close multiple positions within a trading day.

Bitcoin continues to be a very liquid coin that can be easily and quickly bought and sold without significant price movements distorting the trade.

Trading volume

One way to measure liquidity is to check trading volume. With a 24-hour trading volume of $36 billion at the time of writing, bitcoin remains the most traded cryptocurrency.

As a trader, this gives you the guarantee that you can find a counterparty for your long or short positions.

Growing demand

The acceptance of bitcoin ETFs by the US Securities and Exchange Commission (SEC) has further entrenched bitcoin into mainstream finance. Now, institutional investors and robo-advisors can include them in the portfolios of their clients.

Merchants across the globe now accept bitcoin even as many people adopt it for cross-border transactions. The growing popularity of bitcoin ATMs and the ease of accessibility to bitcoin have also driven greater adoption.

All of these mean that the demand for bitcoin is likely to increase. And since higher demand means higher prices, traders (especially those swing trading and position trading) should consider trading bitcoin.

Stability

Altcoins come and go. Many have shown great promise and end up dead. But through it all, bitcoin remains.

But why is stability important to traders?

Trading a cryptocurrency over a long time can lead to a better understanding of the dynamics of that cryptocurrency and this can make it easier to make profitable trades consistently. This is why forex trainers advise that forex traders should focus on a few pairs and understand them well.

The same thing applies to the cryptocurrency market. Experience reduces the learning curve and gives you insights that others won’t have.

Limited supply

One of the reasons for the stability of bitcoin is its limited supply. Supply is limited to 21 million so it can’t be arbitrarily increased, thereby causing a significant fall in prices.

This also ensures that growing demand will result in higher prices without it being counterbalanced by rising supply.

Volatility

Bitcoin, like other cryptocurrencies, is very volatile.

Unlike in cryptocurrency investment where high volatility is an outright problem, traders (especially derivatives traders) look for volatility when selecting cryptos to trade. Traders want assets whose prices can move up and down significantly, providing opportunities to make a profit.

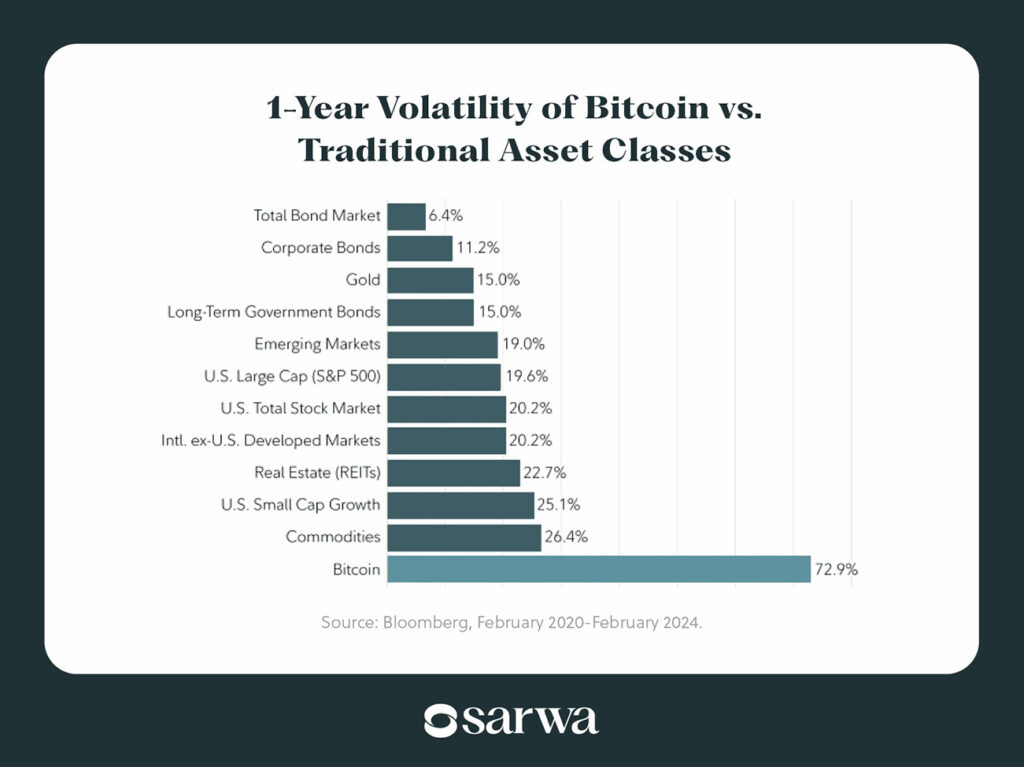

Below is a chart produced by Fidelity Digital Assets, the digital assets arm of Fidelity Investments, an investment management firm, comparing the volatility of BTC with that of other asset classes between 2020 and 2024:

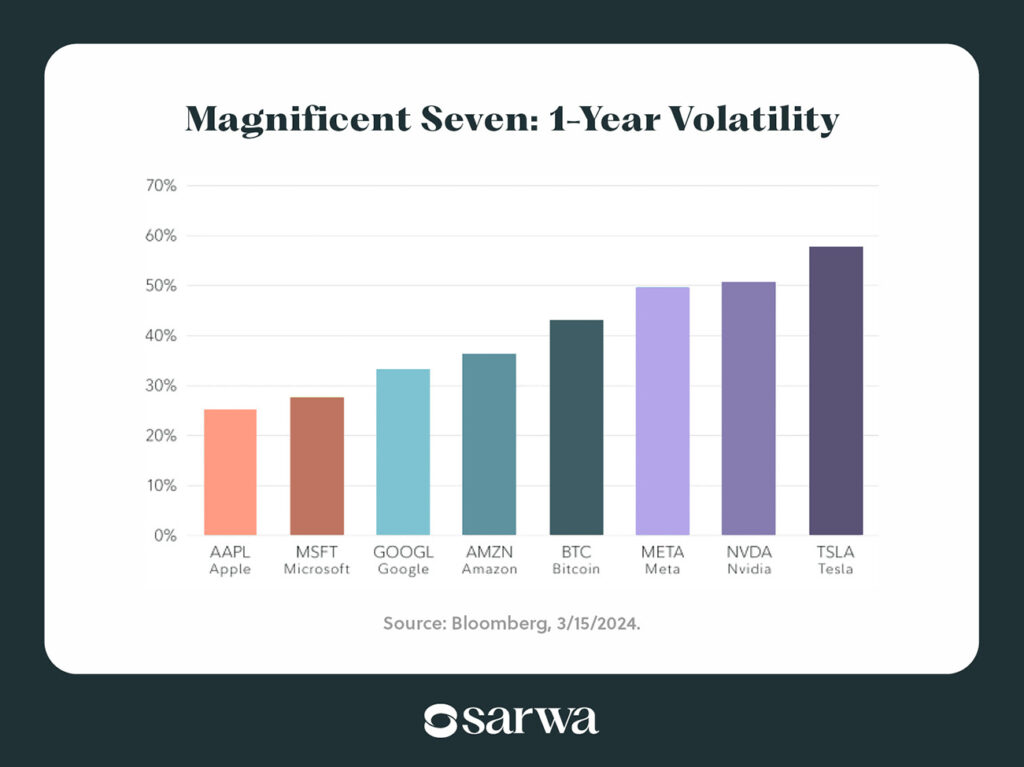

They also note that the volatility of bitcoin is comparable with that of Apple, Microsoft, Amazon, NVIDIA, Tesla, Meta, and Alphabet.

2. The main bitcoin problems today

Volatility

Though some level of volatility is good for traders, there is also a downside: more volatility means more risk. Compared to altcoins, bitcoin is still very stable and less volatile. However, its level of volatility still makes it a high-risk asset that traders need to trade with care.

Security

We have heard stories of investors who lost their passwords and those who lost their crypto wallets to hackers. So, when trading bitcoin there is the risk of misplacing your password and, more importantly, losing your money to hackers.

“With a currency that is 100% technology-based, bitcoin owners are more vulnerable to cyber threats, online fraud and a system that can be shut down,” said Greg Herlean, a member of Forbes Financial Council.

This is another instance where the decentralisation of bitcoin ends up becoming its Achilles’ heel. There is no central agency that you can report and appeal to when you have been defrauded; what you have is a network of computers operating based on blockchain technology.

Fees

Trading bitcoin can become expensive due to the high fees that many bitcoin exchanges charge for transactions.

Congestion on the blockchain network can reduce transaction speed and cause transaction fees to rise significantly.

The recent halving event also led to a rise in transaction fees.

The more transactions you make, the more the fees multiply, eating into your potential investment capital and reducing your profit.

3. Bitcoin trading advice: The do’s of bitcoin trading

Now that we know why you should trade bitcoin and the main problems you should be aware of, let’s consider how to trade bitcoin.

The first set of our bitcoin trading advice focuses on what you should do:

Have a trading strategy and stick to it

Most crypto enthusiasts who entered the market because of someone’s profit and got burnt are those without a strategy.

They just heard that people are making money and wanted to be part of it or they just follow the financial advice of a YouTube “guru” or Twitter influencer.

But it does not work that way.

Just like investors have an investment strategy, successful bitcoin trading requires that you have a trading strategy that can produce more winning trades than losing trades.

A strategy will include when you enter and exit a trade (based on technical analysis – candlestick patterns, moving averages, and indicators), where to put the stop loss (more on that below), when to take profit, and how much bitcoin you should buy for each trade.

The strategy can be summarised in a checklist that shows what must happen before a trade can be made and what you must do when making the trade. Some sophisticated traders even use trading algorithms to automatically buy and sell based on their strategies.

Trading success is not a matter of luck but the consistent application of solid strategies.

Furthermore, when you have selected a strategy, ensure you stick to it. There will be temptations to enter into a trade even when all the items on your checklist have not been checked (because others are doing it). Success depends on resisting such urges and holding on to your strategy.

“Never ever argue with your trading system,” said Michael Coval, an author and entrepreneur in his book, The Little Book of Trading. Top traders know, he continued, “that their ability to stick with a trading plan is far more important than knowing or worrying about what their neighbour is doing.”

Though written in the context of the stock market, it applies neatly to the world of crypto trading.

Prioritise risk management

As said above, a sound strategy will include setting stop losses and position sizing.

A stop loss is used to cut losses when the trade is against you. Without it, a losing trade can result in large financial losses. No matter how good your strategy is, there will be times when market movements are against you. You want to ensure that the losses you take at those times are minimised.

Position sizing is how you determine what portion of your total trading balance you should use to fund a single trade. If you have $1000 and you put all of it in just 2 trades, the losses can be significant when both trades don’t go your way.

With position sizing, you can limit the maximum amount of losses you can incur with a losing trade. It involves setting the maximum portion of your trading balance you are willing to lose in a trade. If that is 2%, for example, then you cannot spend more than $20 on a single trade.

This appears to limit your profit when the trade favours you. But the protection against the downside is more important. As Warren Buffett said, “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.”

Update your strategy when necessary

While you have decided on a strategy, you should stick to it. However, as you gather more knowledge and experience or as market conditions change, you may have reasons to update the strategy to improve your winning ratio.

The key is to ensure that any change in strategy is driven by research and not just by the noise of the market.

Nevertheless, avoid being too ambitious. No one can have a strategy that will produce 100% winning trades. The search for perfection can lead to a rabbit hole where losses can accumulate quickly.

Choose a secure, reliable and cost-effective exchange

Given the insecurity problem associated with bitcoin, you must choose a trading platform (or crypto exchange) with excellent security protocols designed to protect your data and money (via your digital wallet).

Also, the transaction fee problem should make you prioritise trading platforms with low commissions.

In all, choose a trading platform that will enhance your trading experience.

4. Bitcoin trading advice: The don’ts of bitcoin trading

Learning how to trade bitcoin is not limited to what you should do. There are also some things to avoid.

Don’t trade only bitcoin

Just like crypto investing, crypto trading requires diversification for risk minimisation.

You should diversify your trading portfolio by selecting some altcoins along with bitcoin. As we have seen, altcoins tend to produce higher returns and are more volatile. Combining their higher returns with the (relative) stability of bitcoin can improve your overall portfolio performance.

However, the importance of gaining experience and mastering a coin means that you should not have too many coins that you trade consistently. Rather, select a few ones and profit from short-term fluctuations in their market prices.

Of course, this does not exclude investing (buy and hold) in new coins that you believe have great potential. But our focus here is on active trading rather than passive investing.

Don’t be carried away by FOMO

The fear of missing out will often trap you into ignoring your strategy and doing what everyone else is doing.

Most times, by the time a trade has become popular (especially on social media), some people are ready to cash out and those who enter the trade at that time might end up funding the take profit of the early bidders.

This is why those driven by FOMO end up buying high and selling low, making huge losses. “The average man … tends to buy high and sell low,” said Ray Dalio. This statement applies as much to crypto traders as to stock investors.

Don’t join the bandwagon.

Don’t be a captive to fear and greed

Fear can make you take profit earlier than your strategy suggests because you are too concerned about what others are doing.

On the other hand, greed may make you ignore position sizing or set stop losses and take profits higher or lower than they should be.

Don’t fall for scams

Using a reputable and secure exchange is one way to avoid scams.

Trading with spot currencies on cryptocurrency exchanges is also safer than P2P trading. The latter is often a breeding ground for scammers.

More importantly, avoid giving out your private keys to anyone for any reason. Even if they say you have won a million dollars, keep your private keys close to your chest.

The US Federal Trade Commission has more tips that can help you avoid bitcoin scams.

Trading bitcoin in the UAE

If you are in the UAE and you want to trade bitcoin on a reliable, secure, and cost-effective platform, Sarwa Trade is for you.

Sarwa Trade is secure because it uses bank-level 256-bit encryption to protect your data and money. We are also regulated by the Financial Service Regulatory Authority, the agency in charge of Abu Dhabi Global Markets.

Our trading platform only allows spot exchanges (with USD as the fiat currency) so you don’t need to worry about P2P scammers. Moreover, we provide access to altcoins (including ethereum, chainlink, polkadot, tezos, dogecoin, and litecoin, among others) so you can diversify your crypto assets portfolio.

The spread on our cryptos is just 0.75% and you can get started trading crypto with as little as $5. Also, you don’t need to buy a single unit of crypto, you can buy a fraction of a unit. We aim to make our platform serve the interests of retail and beginner traders who don’t have large trading balances.

Sarwa Trade has a well-designed interface that is easy on the eye and comfortable for mobile scrolling. We also provide you with market news (in real-time) that can help you improve your trading.

Finally, transfers from your local UAE accounts to your Sarwa trading account (and vice versa) are free.

[Are you ready to implement our bitcoin trading advice and start your trading journey on the right path? Sign up for Sarwa Trade now for cost-effective, secure, and seamless trading.]

Takeaways

- Despite the popularity of altcoins, bitcoin remains a good crypto for trading because of its volatility, liquidity, trading volume, and stability.

- Insecurity, high fees, and high volatility remain issues that bitcoin traders must face appropriately.

- To succeed with bitcoin trading, you must have a strategy (and stick to it), practice risk management, update your strategy when necessary, and use a reliable, secure, and cost-effective trading platform.

- Conversely, you must avoid investing only in bitcoin, being carried away by FOMO, becoming a captive of fear and greed, and falling for scams.