We want to help you make the best decisions when it comes to your financial future. What is happening in the market is a remarkable event, but it is not an unprecedented one.

Even if we can not predict the future, there are many lessons we can take from the past. Yes, the details of the events are different but from a market perspective, it has always been uncertain times. We have been here before. The great news is, this is great news.

The reality of the market looks even better than this: from this chart, one might think that it took the market a long time to recover from the 1929 crash. However, if you account for dividend reinvestment and deflation’s effects to get real returns, data shows that the market bounced back within only 4.5 years from the world’s greatest depression of 1929.

Whether it’s a pandemic or a world war impacting it, the global economy trends upwards over the long term.

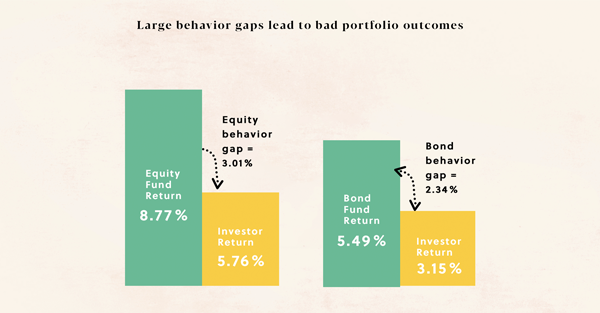

Studies have shown, however, that one of the main drivers of poor portfolio performance is the behavioral gap from investors: Because they let their emotions take the best of them, they buy high, sell low and repeat until broke.

When markets swing, the movement creates concerns and it is not easy to stay calm and stick to the plan. To be a good investor is to be patient. you have to detach your emotions from short term movements and think about your future growth.

A ‘Mind the Gap’ study by Morningstar looked into ‘investors returns’ and behavioral finance. They calculated fund returns using asset-weighted calculation of a fund. What the study showed is that over a 10 year period ending 2017 ( Including the 2008 crash where equity markets dropped 50% from their peak) average fund investors underperformed the funds they owned. In one example of a real fund, the fund itself returned 3.9% over that time period while investors experienced -15.4% of annualized returns! They simply did not stay the course. This is what we call a behavior gap.

Beyond isolated funds, the below graph shows an aggregation of the group of funds to tell an overarching story. The same patterns emerge. Generally investors returns fall short of funds returns. Not only they buy and sell based on irrational decisions, they also tend to sell the performing assets and buy underperforming ones.

The more volatile the market is, the more the behavior gap typically widens.

The one example that stands out in the study and that has a narrowing gap, is the well diversified portfolio where investors are less prone to act on emotions and invest on regular basis.

We teamed up with Andrew Hallam – personal finance author and speaker – to discuss in detail how to navigate the current situation. We looked back on decades of investing in turbulent times and shared tips about what to do and what not to do.

You will find answers to many of your questions in this webinar – just spare a lunch or a movie time!

Ready to invest in your future?