Today, we have moved beyond the times when learning how to make money with cryptocurrency trading was all about buying and selling bitcoin.

Maybe some of your friends were among the first buyers of bitcoin who made millions from it and you regret missing out on all those returns.

Don’t fret! If anything, the opportunities to make money with cryptocurrency have only expanded over the years.

From altcoins to airdrops to staking and IDOs, the opportunities are endless. Also, unlike in the early days when cryptocurrency was mainly for those with a high-risk tolerance, those with a low-risk tolerance can also find opportunities that appeal to them.

Moreover, you don’t need to choose one. You can combine various strategies to build a solid portfolio of cryptocurrencies that will meet your specific appetite for risk.

In what follows, we’ll consider 12 ways to make money with cryptocurrency trading.

[Are you ready to start your cryptocurrency journey in the UAE? Sign up for Sarwa Trade to start investing in and trading your favourite cryptos in a cost-effective, convenient, and secure way.]

1. Trading bitcoin

Altcoins have come and gone but bitcoin remains the biggest cryptocurrency in the world.

It is also the one crypto that has made the greatest inroads into traditional finance (among wealth managers and financial advisors). Just last month, bitcoin ETFs were listed in the US and a few days ago (from the time of writing), Hong Kong had followed suit.

Bitcoin has continued to establish itself due to its limited supply (which makes it a good store of value) liquidity, popularity, and growing adoption as a means of exchange and an investment asset.

You can make money by buying and selling bitcoin either as a day trader, swing trader, position trader, or scalper. Day traders open and close (buy and sell or sell and buy) a trade position within a day, swing traders will leave them for a few days or weeks, while position traders focus on long-term gains (over weeks, months, and even years).

Whichever path you choose, learning how to make money through bitcoin trading will include gaining expertise in fundamental analysis, technical analysis (charts and indicators), trading strategies (when to buy and sell), and risk management techniques (how to minimise risk).

Below are some pieces of bitcoin trading advice you should consider:

- Use leverage wisely: Leverage allows you to trade with money you don’t have so you can boost your returns. But it is also risky since it can amplify your loss if things don’t turn out well. Ensure you have developed a level of expertise before using leverage and when you do, use it wisely.

- Don’t follow the crowd: Whether you are day trading, scalping, swing trading, or position trading, you must have a strategy and stick to it. Do thorough research and don’t be enslaved by the fear of missing out (FOMO).

- Use a safe wallet: Use a trustworthy bitcoin exchange to protect your wallet from scammers. For maximum protection, consider trading a bitcoin trust instead.

- Diversify: As we will see, bitcoin is not the only way to earn in crypto. Don’t put all your eggs in the bitcoin basket, consider spreading them across multiple baskets.

- Bitcoin trading practice: If you are a beginner, consider sharpening your skills with bitcoin trading practice (demo trading). Once you have tested your strategy and you are satisfied with the results, you can start trading crypto with your money.

2. Trading altcoins

Consider two real estate properties: one is a modern house that was just built in a good location and the other is an old house in the same good location.

If you were a real estate flipper, which would you choose to maximise returns? There is more money to be made renovating (making it modern) and selling the old house.

Why this detour?

Well, consider that bitcoin is already a blue-chip crypto with a large market cap. This means that the opportunity to earn outsized market returns is limited. It’s the equivalent of the modern house above.

In contrast, altcoins (other cryptos apart from bitcoin) have a low market cap which means they provide more opportunities to earn larger returns.

Source: Moralis Academy

In addition, many altcoins have interesting technologies that have improved on some limits of bitcoin (faster transaction processing, for example) or contributed to the advancements of crypto as a whole (smart contracts, decentralised finance).

Note however that altcoins are more volatile than bitcoin. One advantage of large and established businesses is that they are more stable while the smaller ones are riskier – they could become big or just fade away. The same thing applies to crypto.

So, the search for higher returns in altcoins means higher volatility (risk).

In terms of actual trading, the tools are the same: fundamental analysis, technical analysis, trading strategies, and risk management strategies. Similarly, the bitcoin trading advice above also apply.

[Interested in learning the technical aspects of trading? Read this article on the top 6 technical indicators needed for day trading.]

3. Crypto mining

Crypto miners are the ones who sustain blockchain networks.

Before a transaction is confirmed and added to some blockchain networks, someone, somewhere has to solve a mathematical puzzle. This is called proof of work consensus in contrast to the proof of stake consensus where validators have to stake a token to confirm a transaction.

Given that miners are crucial to the sustenance of blockchain networks and the operation of the blockchain technology, they are rewarded with the cryptocurrency of the network.

Mining cryptocurrency often requires energy-intensive computing systems. There is CPU mining which uses the CPU of a computer, GPU mining which uses advanced graphics cards, ASIC mining which is an integrated circuit designed for one type of crypto, and cloud mining where miners pay a company to mine on their behalf.

Due to the large computing power required and the cost of acquiring such capacity, many crypto miners decide to come together to increase their success chances (and share the rewards). This is referred to as pool mining (in contrast to solo mining).

If you are new, pool mining is a good place to start. Once you can increase your mining power, you can then consider solo mining.

Note however that crypto mining is not generally profitable for retail investors. To succeed, you might need a GPU or ACIS and both are expensive. If you add the electricity cost, it might become very difficult to break even.

4. Airdrops

If you are a user of social media, you will be familiar with how influencers use giveaways to market products, services, or individual brands.

Marketing is also crucial for new crypto projects. How else can you expect to be heard and seen when there are more than 9,800 cryptos already?

Some of these new projects offer tokens to individuals who follow their page, register on their platform, or hold certain other tokens they are associated with.

Crypto platforms and exchanges also use airdrops when they are introducing a native token. They can offer tokens to current users of the platform as a reward.

On a certain date, the project will then airdrop a certain amount of tokens (for free) to the crypto wallets of those who qualify.

If you are looking for how to earn in crypto but don’t have any starting capital, chasing airdrops can be a good option.

Of course, you won’t know which project will end up succeeding but if you do your research well (evaluating the project’s technology, marketing, and community), you might get free tokens in a project that will end up shooting for the moon.

5. ICOs

Initial coin offerings are the crypto counterparts of initial public offerings (private companies going public).

If an airdrop is how you get free tokens for a new project, an ICO is where you pay for the new cryptocurrency. It is the first public issuance of a project’s tokens and it is an opportunity for those who believe in the project to get in for cheap. The project owners also use the money generated to invest in the project.

The main advantage of an ICO is that you can earn significant returns if the project does well. There have been some success stories in this regard.

Source: Investing.com

However, many coins end up failing or are revealed to be frauds. There are now 1,774 dead coins, according to 99Bitcoins, a site tracking dead coins.

You can follow upcoming ICOs and then evaluate their success potential based on the project technology, its backers and developers, the marketing efforts, and the activeness of the community, among others.

In the end, ICOs are high-risk and high-return investments. If you don’t have a high-risk tolerance, it might not be appropriate for you.

6. IDOs

Initial DEX offerings are the ICO counterparts for cryptocurrencies that will be launched on decentralised exchanges.

Like ICOs, they seek to pull funds from retail investors to invest in their projects. All the retail investors who participate will have some quantities of the crypto according to the amount contributed.

If the project does well, the IDO participants can make huge returns and if things go awry, they may lose their money.

IDOs tend to provide high liquidity, which makes it easier for IDO participants to sell when the crypto goes live. They are also more accessible than ICOs which makes them attractive for project owners.

In addition to the risk of a crypto failing, some IDOs have also turned out to be scams.

Finally, it might be difficult to get allocation for very competitive IDOs.

7. Crypto staking

Do you remember what we said about how learning how to make money with cryptocurrency trading is no longer restricted to those with high-risk tolerance?

Crypto staking is one evidence of that. It is like a high-yield savings account where you can save money for future use and earn passive income.

Staking involves saving your digital assets with a blockchain network that uses it to validate transactions (remember what we said about mining?) and also secure the network. (Ethereum, Tezos, Cosmos, Solana, and Cardano are the popular digital currencies available for staking).

In exchange, you will earn interest, which is a percentage of the amount staked. For example, if you stake 0.5 ETH and the interest rate is 3% APR, you will earn 0.014 ETH.

The interest earned will depend on the blockchain network, the amount you are staking, the duration of the stake, and whether there is a lock-in period within which you can’t withdraw your money.

Most cryptocurrency exchanges have a section devoted to staking and you can find as high as 7% APR on some coins.

The major challenge with crypto staking is price fluctuation. When the price of a coin falls, the interest you will earn will also reduce even if your APR stays the same.

8. Yield farming

Yield farming is similar to crypto staking. However, instead of staking your money in blockchain networks, with yield farming, you are saving them in a liquidity pool of decentralised finance (DeFi) protocols.

DeFi protocols provide decentralised financial services (like peer-to-peer (P2P) lending) outside of the purview of traditional financial institutions. These protocols need liquidity to facilitate the trading of assets.

When you stake money in their liquidity pool, you will earn returns (annual percentage yield). They also offer governance tokens that allow you to vote on issues about the protocol.

(Something similar to yield farming can also be done with NFTs (non-fungible tokens). Instead of selling them, you can stake them on a platform or protocol.)

The yield farming process

Source: CoinGecko

As the name implies, yield farmers tend to move from one liquidity pool to another in search of the best ROI.

It is however important to choose a dependable DeFi protocol since money deposited to a liquidity pool is not insured. If the protocol fails, the money is lost.

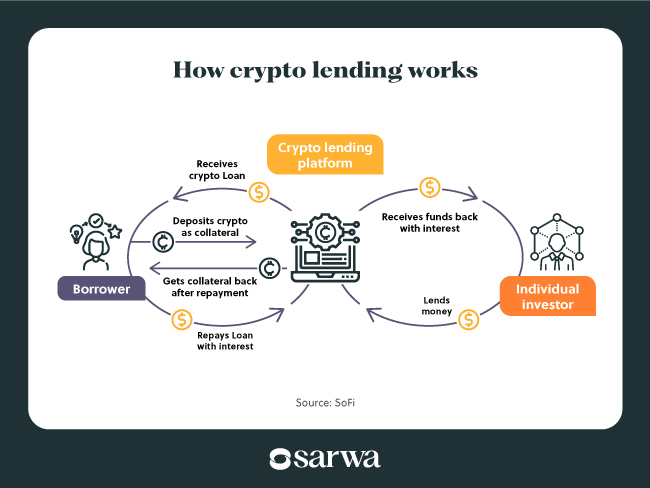

9. Crypto lending

Another option for those with low-risk tolerance is crypto lending.

Some crypto exchanges (trading platforms) like Binance and Coinbase have a lending arm where users can lend crypto to each other. DeFi protocols also offer P2P lending as part of their decentralised financial services.

When you lend crypto to a user, they will pay interest on the amount borrowed in addition to repaying the capital.

The crypto lending process

Source: SoFi

Though most lending platforms require that borrowers have collateral, the unregulated nature of cryptos (especially DeFis) means that there is a possibility that you won’t get back the money lent out.

11. Cryptocurrency investing

Perhaps you are learning how to make money through bitcoin but are the type that does not enjoy following price movements and market trends.

Well, there is more than one way to skin a cat.

Instead of buying and selling digital assets regularly, you can choose to include them as a part of your bigger investment strategy.

This is very common with bitcoin which many investors add to their portfolio of stocks and bonds as a way to achieve more diversification. Some even see bitcoin as digital gold which can provide a hedge against inflation and uncertainty (though actual data has not proven its ability to do this).

For example, with Sarwa Invest, you can invest a maximum of 5% of your portfolio in bitcoin. With this, you can focus on long-term returns rather than short-term profit.

Some investors also have this long-term approach to altcoins. They focus on altcoins with valuable technology and then invest in their long-term potential.

One advantage of investing is that you don’t have to spend your time monitoring price charts or doing technical analysis in general. You only need to do sound fundamental analysis and select the best cryptos with long-term value.

12. Crypto games

Crypto does not have to be all about charts, indicators, blockchain, and all that dense stuff. You can also learn how to make money with cryptocurrency trading and still have fun while at it.

You can make money playing crypto games (adventure, action, RPG, fantasy, etc.) created on blockchain networks.

Some of these games will reward you with popular cryptos while many have their native token that you can then exchange with the more popular ones on crypto exchanges.

Note that some games will require you to have some quantities of a certain token (or the native token) before you can participate. This is because you must make some purchases to enjoy the game’s full experience.

12. Learn and earn

Maybe you are not the gaming type and will prefer to spend your time reading or taking a course than playing a game. There is something for you too.

Some crypto platforms provide learn-and-earn programs where you will get crypto rewards for learning about cryptocurrency. It doesn’t get better than that – being paid for learning how to earn in crypto.

If you want to know how to start in cryptocurrency, consider exploring these learn-and-earn programs.

Interestingly, some platforms that have nothing to do with cryptocurrency are also incentivising people to complete courses by offering them crypto assets.

How to buy cryptocurrency in the UAE

If you are in the UAE and are interested in crypto trading and investing, you can start buying and selling bitcoin (BTC) and some of the most popular altcoins on Sarwa Trade.

Currently, you can buy altcoins like Avalanche (AVAX), Basic Attention Token (BAT), Bitcoin Cash (BCH), Chainlink (LINK), Dogecoin (DOGE), Curve Token (CRV), Ethereum (ETH), Litecoin (LTC), Polkadot (DOT), Tezos (XTZ), and The Graph (GRT).

Whether you are a trader or an investor, Sarwa provides many benefits that will help maximise your trading experience:

- Low commission: We charge only a 0.75% commission for buying and selling cryptos.

- Zero bank transfer fees: Transfers between your local bank account and your Sarwa wallet are free.

- Security: We use bank-level SSL security and your crypto holdings are securely managed through BMO Harris, an American national bank.

- Regulatory compliance: We are regulated both by the Dubai Financial Services Authority and the Financial Services Regulatory Authority.

- Instant deposits: Deposits are completed immediately so you can start trading instantly.

- Fractional trading: You can buy a fraction of a coin if you can’t afford a single coin.

- Low minimum account requirement: You can get started for as low as $1.

- Mobile-first experience: The Sarwa Trade app is mobile-friendly.

- Trading aids: We provide daily news (Sarwa market bites) about the crypto market and publish articles on the blog that will help you trade and invest.

[Are you ready to start making money trading and investing in cryptocurrencies in the UAE? Sign up for Sarwa Trade for a cost-effective, secure, and convenient trading experience.]

Takeaways

- Bitcoin is not the only way to make money in the cryptocurrency market; there are many altcoins available in the market.

- Trading cryptocurrency is not the only way to earn in the crypto space; opportunities abound in crypto staking, crypto ICOs, and crypto investing, among others.

- In today’s market, there are opportunities for all kinds of risk profiles – from the risk-loving investor to the risk-averse investor.

- Before exploring any opportunity in the crypto market, understand and evaluate the risks involved.