For new investors, the investing world can seem complicated at first, making the thought of getting started a bit daunting. But what if you learn how to invest $1,000 in stocks and scale up from there?

The advantage of this approach is that you can fine-tune your investment strategy before you invest more significant amounts in the market.

The lessons you learn from investing $1,000 can then become the foundation for a long-term strategy that sets you up for decades of smart investing.

In this way, you can avoid:

- Losing money to an unproven strategy

- Being distracted by news headlines

- Holding on to cash because you don’t know what to do

In this article, we will show you how to invest $1,000 in the stock market by considering 7 proven strategies that others have used over the years.

[Want to learn how to invest $1,000 in stocks? Schedule a free call with one of Sarwa’s wealth advisors, and we’ll guide you to find the best personal investment strategy to start using our investment app Sarwa Trade to dip your toes into the stock market.]

1. Invest in ETFs

An ETF is a basket of securities that tracks the performance of an underlying index. The common securities that an ETF contains includes stocks, bonds, and REITs.

So, there are stock ETFs, bond ETFs, and REITs ETFs.

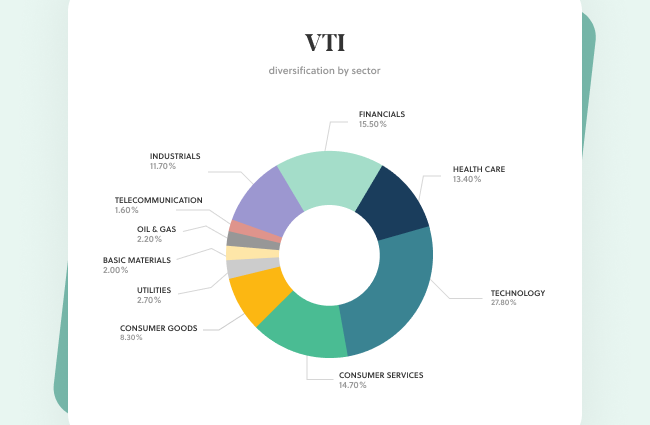

The Vanguard Total Stock Market Index Fund ETF (VTI) is an example of a stock ETF. This ETF contains a basket of 4,100 stocks that are traded in the US stock market.

ETFs allow investors to broadly diversify their investments even if they don’t have millions of dollars to buy shares across thousands of stocks. Before ETFs, an investor looking to diversify their portfolio of investments will need to buy at least one share of many companies. For example, if investor A wants to invest in the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google) at this moment, they will need at least $2,787.85 to buy one share of each stock (at the time of writing).

This means that an investor with $1,000 won’t be able to invest in these five companies. Moreover, a portfolio of five stocks in the same industry does not offer enough diversification.

ETFs changed this whole situation.

With an ETF, an investor with just $189.58 (at the time of writing) can buy a share of VTI and hold a fraction of a stake in 4,100 different companies. This means that through ETFs new investors with less money can also enjoy the benefits of diversification.

What is more, they can even enjoy broad diversification – 4,100 stocks across various industries and market caps.

VTI: Diversification by sector

With $1,000 you can buy more than 5 shares of VTI, which gives you a stake in 4,100 companies or, preferably, you can buy other ETFs in addition to VTI to even enjoy more diversification.

For example, you could buy a bond ETF and a REIT ETF to diversify across asset classes (stocks, bonds, and REITs). Or you could buy a stock ETF that contains stocks that are outside of the US market.

For example, Vanguard FTSE Developed Markets ETF (VEA) invests in other developed markets aside from the US while Vanguard FTSE Emerging Markets ETF (VWO) invests in emerging markets all over the world.

With $1,000, you could buy at least two shares of the following:

- VTI: At $189.58

- VEA: At $41.97

- VWO: At $42.60

- BND (bond ETF): $94.16

- VNQ (REITs ETF): $89.39.

Two shares of each of these will give you a diversified portfolio with just $915.4.

2. Invest with a digital investment platform

Digital investment platforms, or robo-advisors, are financial advisors that provide investors with a preconstructed portfolio that they can passively invest in.

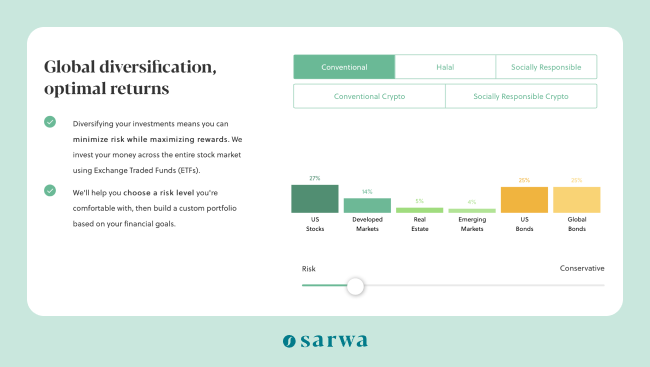

For example, Sarwa Invest uses the Nobel-prize winning Modern Portfolio Theory to create diversified portfolios of ETFs for different types of investors – such as very conservative investors, conservative investors, balanced investors, moderate-growth investors, and growth investors.

A conservative investor with Sarwa Invest will have a portfolio that includes:

- US stocks – 27%

- Developed markets stocks – 14%

- Real estate – 5%

- Emerging market stocks – 4%

- US bonds – 25%

- Global bonds – 25%

This is visually represented in the chart below:

Sarwa Invest’s conservative portfolio

With digital investment tools like Sarwa, you can invest with no minimum in this preconstructed portfolio designed to minimise your risks and maximise your returns based on your unique profile.

For our purposes, you can choose to invest $1,000 in such a preconstructed portfolio after scheduling a free call with one of our wealth advisors, which will help better understand how that portfolio should be made.

[For more on how to build a portfolio, read “Building an Investment Portfolio from Scratch: The Ultimate Guide”]

3. Fractional investing in stocks

Instead of relying on the diversification that ETFs provide, you can also choose to build your own diversified portfolio of stocks through fractional investing.

With fractional investing, you can buy a fraction of a share if you don’t have the money or are not interested in buying a full single share.

In a previous example, we saw that it’ll cost $2,787.85 to buy a share of all the FAANG stocks. But with fractional investing, which you can access on a platform like Sarwa Trade, you can own all the FAANG stocks with $1,000 by buying 0.36 of each stock.

This does not apply only to FAANG stocks. You can create your own portfolio of stocks with $1,000 by purchasing fractions of a share of all of your favourite companies. Once you have created your portfolio with $1,000, you can easily continue to transfer funds from local bank accounts (with no fees) to invest $2,000 or $10,000 or more into the portfolio, or even set up an automated investing plan.

If you have the financial acumen and the time to research stocks, this might be a more attractive option than passively investing in ETFs.

Indeed, creating your own portfolio with fractional investing will give you more freedom and flexibility.

[For more on how to buy your own stocks profitably in the UAE, read “How to Buy US Stocks in the UAE (The Easy and Commission Free Way)”]

4. Invest in dividend stocks

There are two ways you can make money from the stock market: dividends and capital appreciation. And in learning how to invest $1,000 in stocks, you should decide on which one is your priority.

Dividends are quarterly payments that companies make to their shareholders as a reward for their ownership.

For some investors, their primary goal in investing is to earn as much dividend payments as possible. This is often the goal of retirees or those seeking to achieve financial independence through passive income.

The approach that seeks to maximise dividends is called dividend investing and the type of stocks that these investors like are called dividend stocks.

Put simply, dividend stocks are stocks that pay regular dividends. They are mostly the stocks of well-established and financially stable companies like P&G, Coca-Cola, Johnson and Johnson Lowe’s, Chevron Corp, among others. Good dividend stocks don’t just pay regular dividends, they are also committed to increasing the dividend they pay their shareholders.

If earning dividends is a priority, you should invest your $1,000 in dividend stocks. You can do this by buying a dividend ETF( such as Vanguard Dividend Appreciation ETF [VIG]) or using fractional investing to invest in your favourite companies that promise good dividends.

5. Invest in growth stocks

The second way to make money in the stock market is through capital appreciation.

Capital appreciation occurs when the price of a stock rises. For example, if you bought a share at $40 and sold it at $80, you have made $40 in profit.

Unlike dividend stocks that seek to pay regular and increasing dividends, growth stocks aim to grow their share prices so investors can profit from capital appreciation. These companies prefer to reinvest profit into the company so they can grow their earnings (and, by extension, their share prices) rather than prioritise paying dividends to shareholders.

Growth stocks are the preference of investors who want to grow wealth over the long term. The companies behind these growth stocks are often in the introductory or growth stage of their lifecycle with many opportunities to grow.

If capital appreciation is your priority, you should invest your $1,000 in growth stocks. You can do this by buying an ETF of growth stocks (such as Vanguard Growth Index Fund [VIGAX]) or using fractional investing to invest in your favourite growth stocks.

6. Use dollar-cost averaging

In discussing stock trading for beginners, one of the things that new investors are most unsure of is how to get started. The fear of risk can be daunting.

As a response to this anxiety, financial advisors tend to recommend dollar-cost averaging (DCA) as a solution. With this system, you can spread out your investment capital over weeks or months.

For example, if you are afraid of investing $1,000 at once, you can invest $500 every month for the next two months, $200 every month for the next five months or $100 every month for the next 10 months.

This strategy is flexible and can be applied to any of the strategies above, including ETFs, a digital investment platform, fractional investing, dividend and growth stocks.

Aside from taking emotion out of investing and helping you build the discipline needed for consistent investing, DCA can also be a protective measure that is valuable at the beginning or during bear markets.

How so?

Suppose you decided to invest $200 at the end of every month for the next five months in a stock that is currently selling for $20 per share. In the first instalment, you’ll get 10 shares. If the price of the stock drops to $15 the next month, you will now get 13 shares. As long as the price falls compared to the previous month, you will get more shares than if you had invested the whole $1,000 at once.

However, prices can also rise from month to month, in which case you’ll get less shares than if you had invested your $1,000 at once.

This is when lump-sum investing, as discussed next, would be a better option.

Nevertheless, DCA is a good alternative strategy for beginner stock traders who are afraid to enter the market all at once.

7. Use lump-sum investing

If you are not the anxious type who needs DCA, investing all at once (lump-sum investing) is actually a more profitable option.

A study by Vanguard has shown that for a portfolio containing 60% stocks and 40% bonds, lump-sum investing outperformed DCA 67% of the time over six months and 92% of the time over 12 months.

Lump-sum investing vs DCA

Why is lump-sum investing more profitable over the long term?

It comes down to the concept of compound returns.

When you invest your $1,000 immediately, all of it starts earning compound returns. On the other hand, if you only invest $200 this month, only $200 will earn compound returns as of now. Said simply, the earlier you enter the market, the more compound returns you will earn; and the higher the amount with which you enter the market, the higher the compound returns.

As the chart below shows, the longer you invest in the market, the lower the risk of losing money and the higher the probability of making money.

Are you a new investor who wants to start your investment journey on the right track?

You can sign up for Sarwa Invest to access our passive investing platform, download Sarwa Trade for our zero-commision trading app, or if you are still unsure of how to invest $1,000 in the stock market, you can schedule a free call with a Sarwa wealth advisor and we’ll help you get started.

Takeaways on How to Invest $1,000 in Stocks

- Investing can seem complicated for beginners who don’t know how to enter the market.

- By learning how to invest $1,000 in stocks, you can build a good foundation to apply other strategies down the road.

- You can start numerous ways, including by investing $1,000 in ETFs, through a digital investment platform, and by fractional investing in stocks.

- You can also buy dividend or growth stocks.

- New investors who are anxious about getting into the market at once can use dollar-cost averaging while those who are not anxious can use the more profitable lump-sum investing.