It takes a lot of time and money to cultivate a farm land but a single fire incident can destroy it all in under an hour. The implication is that while good things are hard to build, they are often easy to destroy.

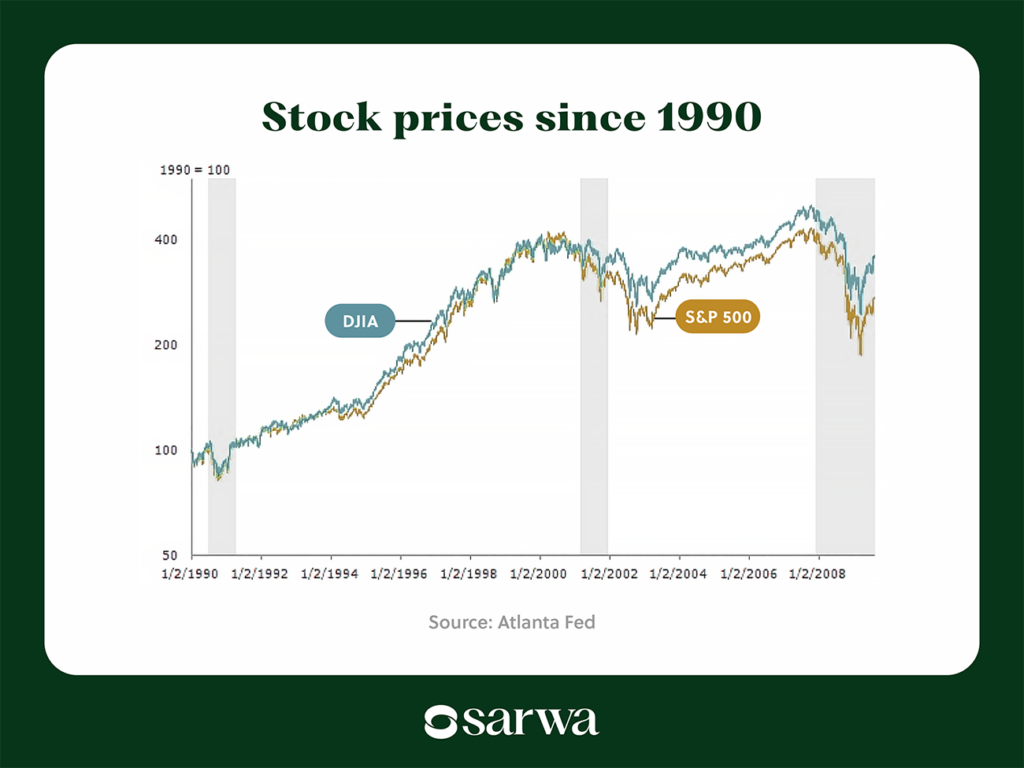

The same concept applies to investing. Between October 9, 2007, and March 9, 2009, the S&P 500 fell by 56.8%, and Americans lost more than $19 trillion in wealth.

With the S&P 500 producing average annual returns of 10.475%, it would have taken about 5 years and 5 months for the index to grow by 56.8%. In essence, what took more than five years to build was lost in less than 2 years.

The 2008/2009 global financial crisis is an example of a black swan event. These rare, outlier, and unpredictable events end up having outsized effects on investors’ portfolios.

Since Nassim Nicholas Taleb, a former Wall Street trader, popularised the black swan theory (in The Black Swan: The Impact of the Highly Improbable and Fooled by Randomness), investors have understood the need to create resilient portfolios to withstand the significant impacts of these negative events.

Though investors have traditionally minimised portfolio risk through diversification, a black swan strategy is a different ball game since its focus is on rare and unexpected events rather than regular market downturns.

In what follows, we will consider what the black swan strategy is about, how it differs from traditional portfolio diversification, and how you can improve your decision-making by combining both,

- What is a black swan strategy?

- How does a black swan strategy differ from traditional portfolio diversification?

- Can you combine a black swan strategy with traditional portfolio diversification?

Do you want to learn more about how to protect your investment portfolio from the impacts of black swan events? Sign up today for Sarwa’s Fully Invested Newsletter for insights that will help you achieve your long-term goals.

1. What is a black swan strategy?

A black swan strategy is an investment strategy that seeks to protect investors from the outsized impacts of black swan events.

The Black Swan Protection Protocol by Universa Investments is an example of a black swan strategy. It is a hedging tool that protects investors from the outsized effects of black swan events. Sarwa now offers this protection protocol to both investors and traders.

To understand this protocol and other black swan strategies, we will identify four key elements common to most of them:

Tail-risk hedging

The concept of tail-risk hedging was introduced by Mark Spitznagel and Nassim Taleb in 2007. Spitznagel created Universa Investments in 2007 with Taleb as a fund advisor. They used the tail-risk hedging strategy to protect their investors from black swan events.

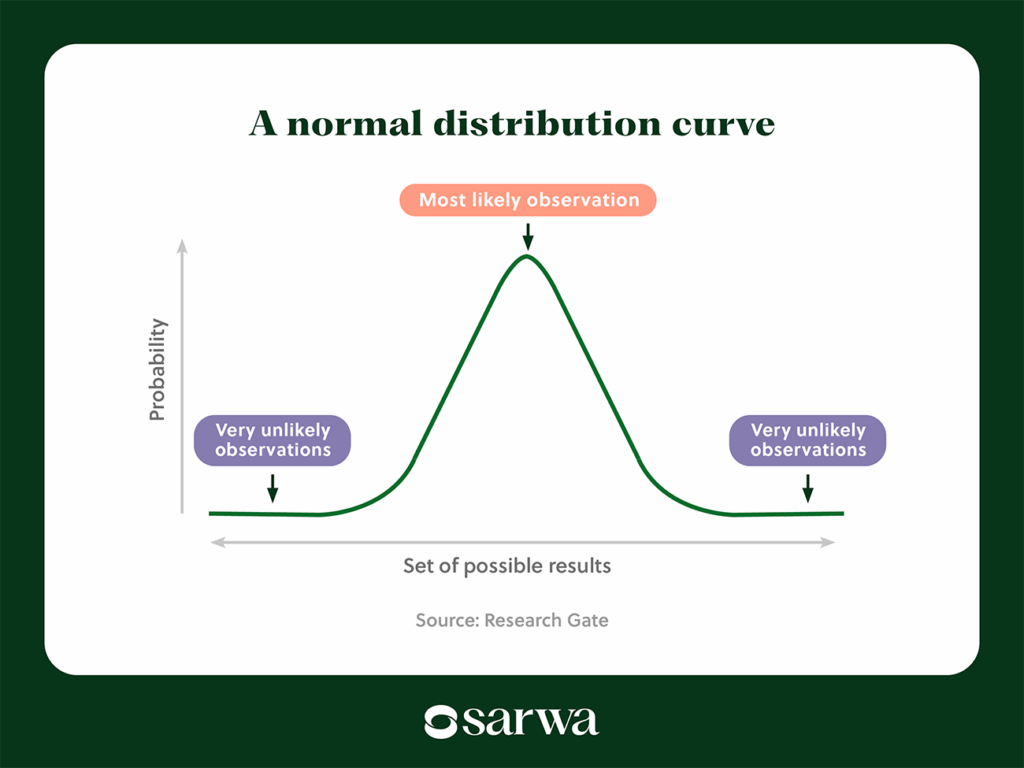

In a normal distribution curve, the tail, as seen below, represents observations with very low probability and large deviations from the mean.

A normal distribution curve

Thus, tail risk refers to the risk that a low-probability and high-impact event happens. In our case, it is the risk that a black swan event will occur.

Universa Investments managed this risk by investing a portion of investors’ portfolios in far out-of-the-money put options.

A put option confers on the buyer the right to sell the underlying asset at a given price (strike price) on or before an expiration date. When the strike price is below the current market price, then the put option is said to be out of the money since the buyer will likely not exercise the right. Why sell for a strike price of $50 (for example) when the current market price is $70?

For more on options, read “What is Options Trading in the Stock Market? All You Need to Know”

Since the put option is out of the money, it will be cheaper to purchase. However, if a black swan event happens and the market price falls drastically to $10, the far out-of-the-money option suddenly becomes in the money as the investor can sell the underlying asset for $50 when everyone is selling for $10 in the spot market.

In essence, an out-of-the-money put option is insurance against black swan events. If such events don’t occur, the investor loses a little money (since far out-of-the-money options are cheap). But when they occur, the investor can make a huge amount of money that more than compensates for the little amounts lost when the event did not happen.

Some investors and investment firms also use the volatility index (VIX) to hedge against tail risk. This is an index that measures expectations of near-term volatility in the market. When the market experiences sharp downturns, the VIX goes up, and vice versa.

By purchasing a VIX call option, future, or ETF, investors can profit when these unexpected and rare events cause a massive drop in the stock market.

Safe haven assets

Black swan investors also like to keep a portion of their portfolios in assets that do well during economic downturns.

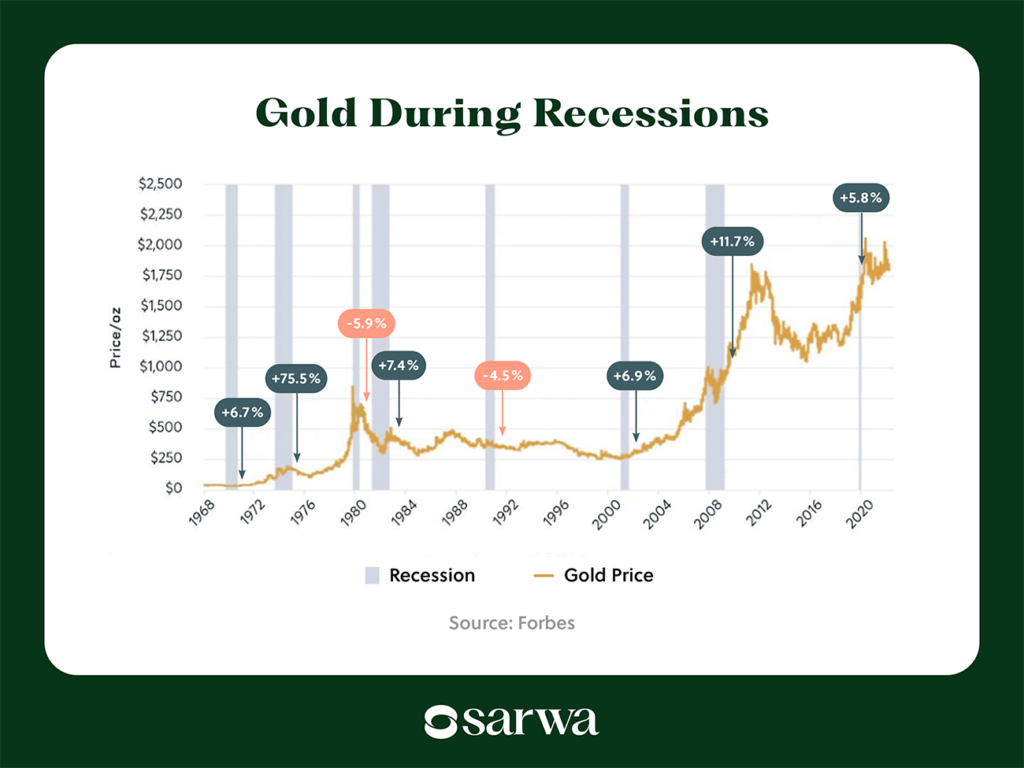

Gold is an example of such an asset. As seen below, gold produced positive returns in six out of the last eight economic recessions.

Furthermore, gold outperformed the S&P 500 index during all economic recessions that happened between 1968 and 2022, according to Forbes.

By learning how to invest in gold, investors and fund managers can hedge against the outsized impacts of black swan events.

Resilience over prediction

Thirdly, a black swan model is not reactionary. That is, it does not wait till a black swan event has happened to start adjusting the structure of a portfolio. Instead, since black swan events, by their very nature, are unpredictable, it ensures that resilience is built into the portfolio at every point in time.

To use the example we started with, it does not think about what to do after a fire incident has happened. Rather, it ensures that there are enough strategies in place to put the fire out and prevent it from doing damage any time it happens.

Cash buffers

Some black swan investors also prefer to hold a portion of their portfolio in cash and cash equivalents.

In a financial crisis, some wonderful companies (to use Warren Buffet’s term) will also see a drop in their share price. This is an opportunity for smart investors to pick up those stocks for cheap.

“The best chance to deploy capital is when things are going down,” said Warren Buffett.

“During a market panic, liquidity is king,” according to Dave Karpinsky, a director at Accenture, the global management consulting firm. “When asset prices are falling rapidly, the ability to move quickly can make the difference between seizing an opportunity and suffering a loss. The Black Swan Investor always maintains a portion of their portfolio in cash or cash equivalents, ready to deploy when others are forced to sell.”

2. How does a black swan strategy differ from traditional portfolio diversification?

The importance of portfolio diversification is in its ability to reduce the risk that investors face.

An introduction to portfolio diversification

In popular language, diversification means not putting all your eggs in one basket. If you scatter your eggs across five baskets, then the loss of one basket will not be fatal since there are four other baskets of eggs.

A diversified portfolio contains assets that are either uncorrelated, negatively correlated, or only a little bit positively correlated to one another.

When two assets are positively correlated (correlation coefficient between 0 and 1), then a fall in the price of one will lead to a fall in the price of the other. If the correlation coefficient is small, then a big fall in one asset will lead to only a small fall in the other. But if the coefficient is high, a big fall in one asset can lead to a big fall in the other asset.

On the other hand, when two assets are negatively correlated, a fall in the price of one will lead to a rise in the price of the other.

Finally, when two assets are uncorrelated (the correlation coefficient is zero), it means that a change in the price of one does not affect the price of the other.

There are four popular ways to diversify a portfolio:

- By asset class: This involves investing in multiple asset classes: stocks, bonds, real estate investment trusts (REITs), crypto, etc. By combining high-risk and low-risk assets, the investor can minimize total portfolio risk.

- By industry: This is a diversification method that spreads investment across multiple industries (finance, consumer durables, health, etc.). It ensures that a poor run of results in one industry does not cripple an investor’s portfolio.

- By market cap: An investor can also purchase large-cap, mid-cap, and small-cap stocks to achieve a proper balance of risk and return. While small-cap stocks tend to be high-risk, high-return, large-cap tend to be low-return, low-risk, with mid-cap in between.

- By region: Developed markets like the US have a low-risk and low-return profile while emerging markets like Brazil have a high-risk, high-return profile. Investing in both markets can help achieve a balanced risk-return profile.

Investors have used a combination of these four strategies to minimize portfolio risk over the years.

The differences between a black swan strategy and traditional portfolio diversification

How then does this portfolio diversification differ from a black swan strategy?

Let’s highlight five important differences:

Systematic risk vs unsystematic risk

Finance experts differentiate between two types of risk: systematic risk and unsystematic risk.

A systematic risk (also known as market risk) is a risk that affects the entire market or a large part of it. This type of risk is not limited to one asset class or industry. Systematic risk can arise because of economic recessions, inflation, financial market crises, political instability, natural disasters, etc.

It is interesting that finance experts also call it a non-diversifiable risk. All your investments across industries, asset classes, and market caps are affected. Also, given the interconnectedness of the global economy, systematic risk in one country can cause disruptions in another (what is called the contagion effect), as the 2008/2009 global recession exemplifies.

Unsystematic risk (also known as diversifiable risk) is unique to a company, industry, or even asset class. It does not affect the entire market.

Why is this distinction important?

Traditional portfolio diversification is designed to deal with unsystematic risk but it cannot deal with systematic risk. Even if your portfolio is diversified by industry, asset class, market cap, and region, systematic risk will still affect it.

In contrast, a black swan strategy is specifically designed to deal with systematic risk. The type of events that constitute systematic risk – economic recessions, natural disasters, and political instability – are similar to black swan events and these are the exact events that a black swan strategy protects your portfolio against.

Black swan events versus normal contractions and bear markets

Finance experts see a 10% drop in a stock market index from a recent swing high as a correction. Corrections are a normal part of the market cycle as the market cannot go up indefinitely. Though one cannot fully predict them, they can be expected to occur periodically.

A bear market is a 20% drop from a recent swing high. Bear markets last longer than market correction and their negative impacts are more significant. Though they can be anticipated, their duration and significance cannot be accurately predicted. The 1987 stock market crash and the dotcom crash between 2000 and 2002 are good examples.

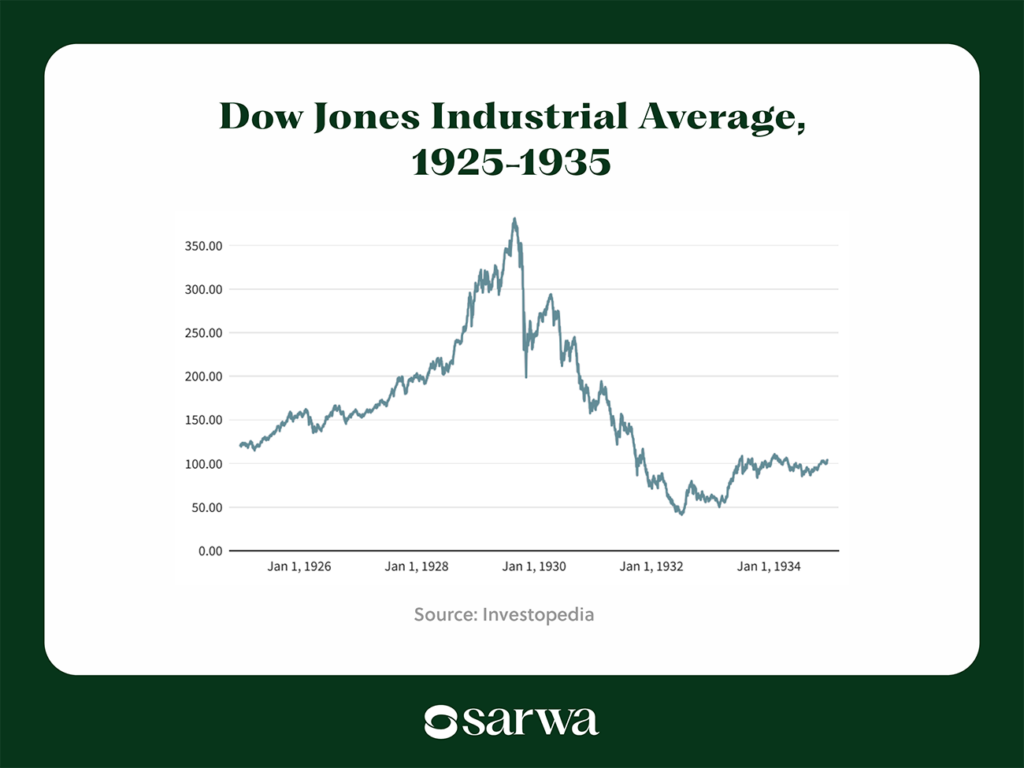

Black swan events tend to be more severe than both market corrections and bear markets. The global depression of the 1930s led to an 89.2% drop in the Dow Jones Industrial Average.

Also, while corrections and bear markets can be expected as a part of the normal market cycle, black swan events are rare and unpredictable, they are only obvious in hindsight. The COVID-19 pandemic is a recent example.

Finally, while the effects of corrections and bear markets can be short-to-medium term, black swan events usually have long-lasting effects.

Why is this distinction important?

While portfolio diversification can help in market corrections and bear markets, it is usually insufficient when it comes to the severity and unpredictability of a black swan event.

Risk-mitigation strategies

Portfolio diversification focuses on investing in assets with low correlation to minimize total portfolio risk.

On the other hand, a black swan model employs more advanced risk management tools like derivatives (options and futures), VIX, and cash buffers, among others.

Planning vs reacting

In many cases, investors and portfolio managers have to rebalance a diversified portfolio during a correction or bear market to achieve maximum protection. This is because they don’t usually know which asset class, industry, region, or market-cap type will perform well during a particular downturn.

For example, if only 1% of a portfolio is invested in the consumer staples industry and that industry turns out to be the one that holds up during a bear market, the portfolio manager or investor has to reallocate more funds to that sector. But who knows if it is healthcare that will hold up in the next bear market?

In contrast, a black swan strategy is all about ensuring that the portfolio is well protected irrespective of what shape or form the black swan event takes. There is no need for constant portfolio rebalancing.

Risk vs return

Warren Buffett once said that diversification is a protection against ignorance. He also said that while diversification may preserve wealth, it is concentration that builds it.

His point is that while diversification can reduce risk, it can also reduce potential returns. In essence, greater risk protection can come at the expense of lower returns.

For example, a standard diversification strategy will include adding bonds to your portfolio. Though bonds are not as risky as stocks, they provide very little returns and their performance in economic downturns is unconvincing.

In contrast, because a black swan strategy has insured you against the worst outcome (a black swan event), it gives you the liberty to pursue a more aggressive growth strategy (focusing on high-return assets) in normal times.

“If you’re frustrated by the large share of bonds in your portfolio or their poor performance during key shocks in recent years, then the Black Swan Protection Protocol by Universa is for you,” according to Mark Chawan, the CEO and co-founder of Sarwa. “It helps you manage tail-risk and hedge against big market shocks. At the same time, it lets you invest more aggressively in higher-growth assets like US stocks. It’s a win-win: you are “anti-fragile” during crashes while benefiting from strong equity exposure in non-crash years.”

Consequently, a black swan model can produce higher returns during black swan events as well as higher long-term returns because it frees you to be more ambitious in non-crash periods. For example, while the S&P 500 produces an average annual return of about 10%, Universa Investments produced a 105% annual return on capital between 2008 and 2019, according to a report by Business Insider.

3. Can you combine a black swan strategy with traditional portfolio diversification?

Since traditional portfolio diversification and black swan strategy seek to tackle different investing challenges (systematic vs unsystematic risk; market corrections and bear markets vs black swan events) – the smart investor should seek to combine them.

How so?

Let’s consider the example of an investor with the following diversified portfolio:

- US stocks: 30%

- Emerging market stocks: 10%

- Developed market stocks: 10%

- REITs: 10%

- US bonds: 20%

- Global bonds: 20%

We assume that the stocks are well diversified across industries and market caps.

To combine this diversified portfolio with a black swan strategy, four things need to happen (based on everything we have said so far):

- A portion of the portfolio has to be allocated towards tail-risk hedging. This will provide insurance against black swan events.

- The portion allocated to bonds should be reduced: Since bonds neither offer high returns in good times nor protection during downturns, the portion allocated to them should be reduced.

- A small cash buffer should be held to take advantage of low prices when black swan events happen: This helps to snatch up wonderful companies at cheap valuations.

After doing all these, the portfolio can look like this:

- Black Swan Protection Protocol: 2%

- Cash: 5%

- US stocks: 40%

- Developed markets stocks: 10%

- Emerging markets stocks: 10%

- Gold: 10%

- REITs: 5%

- US bonds: 5%

- Global bonds: 5%

This is just an example to show that a combination of both strategies is possible. It is not a recommendation to be followed.

If you are in the UAE and want to protect your portfolio with a black swan strategy, Sarwa’s Black Swan portfolio is an opportunity you can explore. This portfolio is based on the Black Swan Protection Protocol offered by Universa Investments.

Passive investors can adopt the Black Swan Protection Protocol through Sarwa Invest while active investors can use it through Sarwa Trade. With this protocol, you can focus on achieving your investment goals unbothered by the extreme impacts of black swan events.

Are you ready to protect your portfolio and earn higher long-term returns? Sign up for Sarwa today to gain access to our Black Swan portfolio.

Takeaways

- Black swan events have severe consequences that can wipe out in months money that took years to accumulate.

- Unlike traditional diversification, which spreads risk across asset classes, a black swan strategy specifically hedges against extreme, unforeseen events using tools like tail-risk hedging, volatility index options, and safe-haven assets.

- By providing insurance against catastrophic losses, black swan strategies enable investors to take on more risk in normal market conditions, potentially leading to higher long-term returns compared to conventional diversification alone.

- Investors can benefit from both strategies by reducing bond allocations, incorporating hedging tools, holding safe-haven assets like gold, and maintaining a cash buffer to seize opportunities during downturns.